Careers

Executive and Employee Interviews

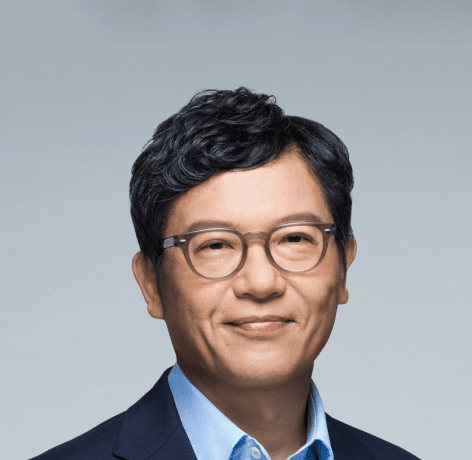

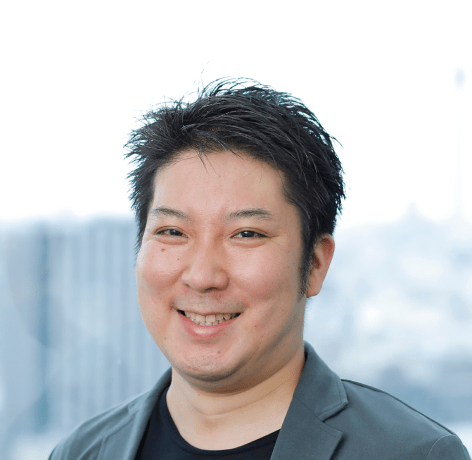

Message from the CEO

We will continue to create products and services that can make life easier and more convenient that make people wonder, "How did we live without them?" If we can contribute to society by doing this, we will have no greater joy.

Hisayuki Idekoba