Newsroom

- IR

Recruit Holdings Co., Ltd. Announces a Partial Revision of the Stock Incentive Plan for its Board Directors, etc.

May 15, 2018

TOKYO, JAPAN (May 15, 2018) - Recruit Holdings Co., Ltd. (the "Company") announces that it resolved at its Board of Directors meeting to submit a proposal to the 58th Ordinary General Meeting of Shareholders scheduled for June 19, 2018 (the "General Meeting") regarding the partial revision of the stock incentive plan (the "Scheme") the Company introduced in FY2016 for the Board Directors, Corporate Executive Officers, and Corporate Professional Officers of the Company.

1. Outline of the Revision to the Scheme

At the 56th Ordinary General Meeting of Shareholders, the Company was approved to introduce the Scheme which incorporated a performance-based stock incentive plan, effective for the Board Directors (excluding External Board Directors), Corporate Executive Officers and Corporate Professional Officers. However, the Company seeks approval to revise the Scheme at the General Meeting in order to better serve the pursuit of the Recruit Group's (the "Group") management philosophy, and to thereby achieve further expansion of its businesses on a global scale.

Since 2012, the Group has proactively sought to drive its business toward a full scale of global expansion. As a result, the percentage of overseas revenue expanded from approximately 3% as of the fiscal year ended March 2012, to approximately 46% as of the fiscal year ended March 2018. In order to continuously increase the enterprise value of the Group, the Company believes it is an exceedingly important managerial theme to develop a business foundation which may become a platform for the overseas market and lead to scalable global business. For this reason, the Company believes it is necessary to bring in highly talented corporate executives with an abundance of knowledge, market experience and network in the global IT industry. As a result, the Company will submit a proposal regarding the appointment of Mr. Rony Kahan as a Board Director. Mr. Kahan is the co-founder of Indeed, Inc., a Group company, and he continued to lead Indeed, Inc.'s extensive growth even after the acquisition by the Company.

Meanwhile, remuneration for overseas corporate executives generally includes the following:

1. A majority of their remuneration is paid in stock.

2. Stock incentive plans based on non-performance metrics are frequently used together with the plans based on performance metrics, which decide the number of stocks to be granted based on the level of attainment of specific management targets.

3. Stocks can be flexibly granted during his/her term of office.

The Company believes that incorporating the global standards into the remuneration scheme, such as the above, is one of the conditions which need to be met to win over competitors from the aspect of recruiting corporate executives, and thus facilitate the acquisition of top tier corporate executives.

Therefore, since having a flexible stock remuneration scheme similar to that of global IT companies is vital to acquiring top tier corporate executives with a high level of global standard expertise, experience and networking, the Company has resolved to conduct a partial revision of the Scheme.

The revision includes adding External Board Directors to the Persons subject to the Scheme based on non-performance metrics, only in the case where he or she is recruited based on the standards of markets with significantly different employment practices, laws and regulations. Regardless of the approval of the partial revision of the Scheme at the General Meeting, the stock incentive for Board Directors who also serve as Corporate Executive Officers and Corporate Professional Officers for the fiscal year ending March 2019 will continue to be granted based on performance metrics at the time of their retirement, in principle.

(Reference) Summary of the Revision

| Before the Revision | After the Revision | |

|---|---|---|

| 1) Persons subject to the Scheme | Board Directors (excluding External Board Directors), Corporate Executive Officers, and Corporate Professional Officers of the Company | Board Directors, Corporate Executive Officers, and Corporate Professional Officers of the Company

(*)External Directors are included only when the person is recruited based on the standards of markets with significantly different employment practices, laws and regulations (persons subject to the Scheme are hereinafter collectively referred to as the"Board Directors, etc.") |

| 2) Linkage to performance | Performance based | Performance based or non-performance based

(*) Performance-based remuneration is not applicable to External Board Directors. |

| 3) Timing of grant, etc. of the Company's shares, etc. | At the time of retirement, in principle | At the time of retirement or a certain period while still incumbent |

In regard to the implementation of the Scheme, a Board Incentive Plan Trust Structure (the "BIP Trust Structure") has been adopted and used since 2016. The BIP Trust Structure is a stock incentive plan in which the Company's shares are acquired through a trust (the "Trust") using the funds contributed by the Company as remuneration for the Board Directors, etc., and a grant or payment (the "grant, etc.") of the Company's shares and money equivalent to the converted value of such shares (the "Company's shares, etc.") are offered to the Board Directors, etc. according to their individual rank and the level of attainment of performance targets or the like.

Upon revising the Scheme, as stipulated in section 2.4.(i) below, the maximum financial contribution by the Company for each fiscal year in the Scheme will be set at 2.5 billion yen. The 56th Ordinary General Meeting of Shareholders, which was held on June 21, 2016, approved that (i) the maximum total financial contribution to the Trust, as defined below, shall be 2.5 billion yen for each fiscal year, and that (ii) if the Company establishes a new trust (including changes to a trust contract and making additional contributions to the Trust), each trust will be set within the maximum total contribution of 2.5 billion yen for each fiscal year. Therefore, even after the revision of the Scheme, there will be no change in the maximum financial contribution by the Company in each fiscal year.

Furthermore, the 56th Ordinary General Meeting of Shareholders approved the amount of stocks for grant, etc. by the Company to be limited to 740,600 shares per year. Following the stock split of the Company's shares on July 1, 2017, an adjustment according to the rate of increase was conducted, and the total maximum share amount was changed to 2,221,800 shares per year. As stipulated in section 2.4.(ii), upon revision, the grant, etc. of the Company's shares, etc. should be set at the same maximum limit of 2,221,800 shares.

2. Details of the Scheme after the Revision

1) Persons subject to the Scheme (beneficiary requirements)

During a predetermined period, the Board Directors, etc. are eligible to receive the grant, etc. from the Trust for the number of the Company's shares, etc. corresponding to the accumulated number of points (as defined in 2) below) on the condition that they meet the beneficiary requirements.

The beneficiary requirements are as follows:

(i) Entitled as a Board Directors, etc. of the Company;

(ii) Has not resigned due to personal reasons or dismissal, or committed certain illegal conduct during his/her term of office;

(iii) The accumulated number of points (as defined in 3) below) has been determined; and

(iv) Other requirements deemed necessary to attain the aim of the share remuneration plan.

2) Calculation Method of Number of the Company's shares, etc. to be delivered as the grant, etc. to the Board Directors, etc.

The Company shall grant points to each of the Board Directors, etc. when establishing the Trust according to their individual rank and the level of attainment of performance targets or the like. The number of the Company's shares, etc. to be delivered from the Trust to the Board Directors, etc. under the Scheme shall be determined as one share per point. In the event of an increase or decrease in the number of the Company's shares held in the Trust due to a share split, an allotment of shares without contribution or a share consolidation, etc., the Company will make an adjustment to the number of the Company's shares delivered as the grant, etc. for each point in accordance with the ratio of such increase or decrease.

(Point calculation formula)

Amount of stock-based remuneration ÷ Average acquisition unit price of the Company's shares held in the Trust (If the trust period is extended through amendments to the trust agreement or additional contributions to the Trust, this shall be the average acquisition unit price of the Company's shares acquired by the Trust after such extension of the trust period.)

* Truncated after decimal point

* In the case of non-performance-based remuneration, the amount of stock-based remuneration shall be the standard amount based on the individual rank, etc. of the Board Directors, etc.

* n the case of performance based remuneration, the amount of stock-based remuneration shall be calculated by multiplying the standard amount based on the individual rank, etc. of the Board Directors, etc. by performance-linked factors, which are based on the level of attainment of a performance target indicator against the target. If the level of attainment of a performance target indicator against the target is low, no remuneration may be paid under the Scheme.

* The performance target indicators for the scheme are Adjusted EPS, EBITDA or the like.

EBITDA for the existing businesses has been used as the performance target indicator since the fiscal year ended on March 2016. However, as acquisitions of companies aiming for an increase of enterprise value may create synergy after consolidation with existing businesses, separating EBITDA for the existing businesses and EBITDA for the newly acquired businesses may become difficult. Therefore, the Company will use the level of attainment of the Adjusted EPS and EBITDA, which were set during the fiscal year ended March 2017, as the performance target indicators for the stock-based remuneration for the fiscal year ending March 2019. Meanwhile, mergers and acquisitions and the sale of subsidiaries during the fiscal year have a significant impact on the EBITDA outlook, therefore, the EBITDA target may change when the Board of Directors, including External Board Directors, deems it necessary. The performance-linked factor shall be within the range of 0% to 150%, which has remained unchanged since the fiscal year ended March 2016.

* EBITDA = operating income + depreciation and amortization ± other operating income/expenses

※ Adjusted EPS = Adjusted net income*1/ (number of shares issued at the end of the period - number of treasury stock at the end of the period)

*1 Adjusted net income = Net income attributable to owners of the parent ± adjustment items*2

*2 Adjustment items = Amortization of intangible assets arising due to business combinations ± non-recurring income/losses

3) Method and timing of the grant, etc. of the Company's shares, etc. to the Board Directors, etc.

At the time of retirement or a certain period while still incumbent, as predetermined, the Board Directors, etc. meeting the beneficiary requirements shall receive the grant, etc. of the Company's shares, etc. from the Trust corresponding to the accumulated number of points calculated according to 2) above (the "accumulated number of points"). In such instance, the Board Directors, etc. may be granted a certain percentage of the Company's shares corresponding to the accumulated number of points (fractional shares are omitted), while the remaining Company shares corresponding to the points are converted to money within the Trust and paid to the Board Directors, etc. in money. If the Board Directors, etc. do not have securities transaction accounts that can handle Japanese shares, all the accumulated number of points are converted to money within the Trust and paid to such Board Directors, etc. in money.

In the event of the death of a Board Director, etc. during his/her term of office, the Company's shares corresponding to the number of points accumulated up to his/her death shall be converted to money and paid to his/her heirs from the Trust.

4) Maximum amount of total trust money to be contributed to the Trust and maximum total number of Company's shares, etc. to be delivered from the Trust as the grant, etc. to the Board Directors, etc.

(i) Maximum amount of total trust money to be contributed to the Trust

The Company establishes a Trust (*) by contributing money not exceeding 2.5 billion yen each fiscal year (including 200 million yen set aside for External Board Directors; the same shall apply hereinafter) as remuneration for the Board Directors, etc. The Company may establish more than one Trust within a single fiscal year. In this case, the total trust money to be contributed to these Trusts shall be subject to the maximum amount of 2.5 billion yen. In the event that the establishment of a Trust that has been scheduled to be established in a particular fiscal year becomes impossible in light of the applicable laws and regulations, etc., a Trust pertaining to such fiscal year may be established at some appropriate time in or after the following fiscal year. In this case, such Trust shall be subject to the maximum total trust money pertaining to the fiscal year for which it was originally scheduled to be established, rather than the maximum total trust money pertaining to the fiscal year in which the Trust is actually established.

* At the expiry of the trust period for the Trust, the Trust may be continued for the operation of the Scheme by way of modifying the trust agreement and making additional contribution in lieu of the establishment of a new Trust. In this case, the Company will contribute additional trust money within the limit of 2.5 billion yen for each fiscal year, and during the extended trust period the Company will continue to grant points to the Board Directors, etc. and continue the grant, etc. of the Company's shares, etc. thereto.

In addition, if neither modification of the trust agreement nor additional contribution is carried out, but the Board Directors, etc. who may meet the beneficiary requirements remain in office at the expiry of the trust period for the Trust, although no further points shall be granted to them after the expiry, the trust period of the Trust may be extended for a period of up to ten years until the completion of grant, etc. of the Company's shares, etc. to such Board Directors, etc.

(ii) Maximum total number of the Company's shares, etc. to be delivered as the grant, etc. to the Board Directors, etc.

The maximum total number of the Company's shares, etc. to be delivered as the grant, etc. to the Board Directors, etc. from the Trust shall be 2,221,800 shares for each fiscal year (including 177,600 shares set aside to External Board Directors). These maximum total points have been established in view of the maximum total trust money stipulated in (i) above and in reference to the stock price, etc. at the time of introduction of the Scheme in FY2016.

The limit of 2,221,800 shares for each fiscal year was increased to that amount from the original amount of 760,600 shares that was approved at the 56th Ordinary General Meeting of Shareholders, following the adjustment according to the rate of increase of the stock split on July 1, 2017.

5) Method for the acquisition of the Company's shares by the Trust

The Trust is scheduled to acquire the Company's shares from the stock market.

6) Voting rights for the Company's shares held in the Trust

For the purpose of ensuring neutrality in management, no voting rights shall be exercised for the Company's shares held in the Trust during the trust period.

7) Distribution of dividends associated with the Company's shares held in the Trust

The distribution of dividends associated with the Company's shares held in the Trust shall be received by the Trust and appropriated to the trust fees and trust expenses for the Trust. Any residual amount at the eventual termination of the Trust after the aforementioned appropriation to the trust fees and trust expenses will be donated to organizations with no interest in the Company.

If the Trust is to be continuously operated after the expiry of the trust period, such residual amount shall be utilized as share acquisition funds.

8) Treatment at the expiry of the trust period

In the case that residual shares remain at the expiry of the trust period due to reasons such as failure to attain performance targets etc., the Company may continuously operate the Trust as an incentive plan similar to the Scheme by amending the trust agreement and making additional contributions to the Trust. If it is decided to terminate the Trust at the expiry of the trust period, the Trust shall transfer the residual shares to the Company without compensation, and the Company plans to acquire the same without compensation and to cancel them by a resolution of the Board of Directors.

3. Implementation of the Scheme after Revision

On condition that the approval pertaining to 1. and 2. above is obtained at the General Meeting, the Company plans to establish a new trust for certain Board Directors, etc. as follows.

(Outline of the trust agreement)

| 1) | Type of trust | Monetary trust other than a specified solely-administered monetary trust (third-party benefit trust) |

|---|---|---|

| 2) | Purpose of trust | Providing incentives to the Board Directors, etc. of the Company |

| 3) | Entruster | The Company |

| 4) | Trustee | Mitsubishi UFJ Trust and Banking Corporation (planned) (Joint Trustee: The Master Trust Bank of Japan, Ltd.) |

| 5) | Beneficiary | The Board Directors, etc. who meet the beneficiary requirements |

| 6) | Trust administrator | A third party with no interest in the Company |

| 7) | Date of trust agreement | August 14, 2018 (planned) |

| 8) | Trust term | August 14, 2018 (planned) to August 31, 2021 (planned) |

| 9) | Commencement date of the scheme | August 14, 2018 (planned) |

| 10) | Exercise of voting rights | Voting rights will not be exercised. |

| 11) | Class of shares to be acquired | Common stock of the Company |

| 12) | Amount of trust | 0.3 billion yen (planned) (including trust fees and trust expenses) |

| 13) | Timing for acquiring shares | August 15, 2018 (planned) to September 14, 2018 (planned) |

| 14) | Method of share acquisition | Acquisition from the stock market |

| 15) | Rights holder | The Company |

| 16) | Residual assets | The Company, as the rights holder, may receive residual assets within the scope of reserve for trust expenses after deducting share acquisition funds from the trust money. |

(Note) The scheduled dates mentioned above may be changed to appropriate dates in light of applicable laws and regulations.

[Details of administration relating to the trust and shares]

| 1) | Trust-related administration | Mitsubishi UFJ Trust and Banking Corporation and The Master Trust Bank of Japan, Ltd. are to be the trustees of the Trust and will conduct trust-related administration. |

|---|---|---|

| 2) | Share-related administration | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. will conduct administration related to the delivery of the Company's shares to beneficiaries based on the administration service agreement. |

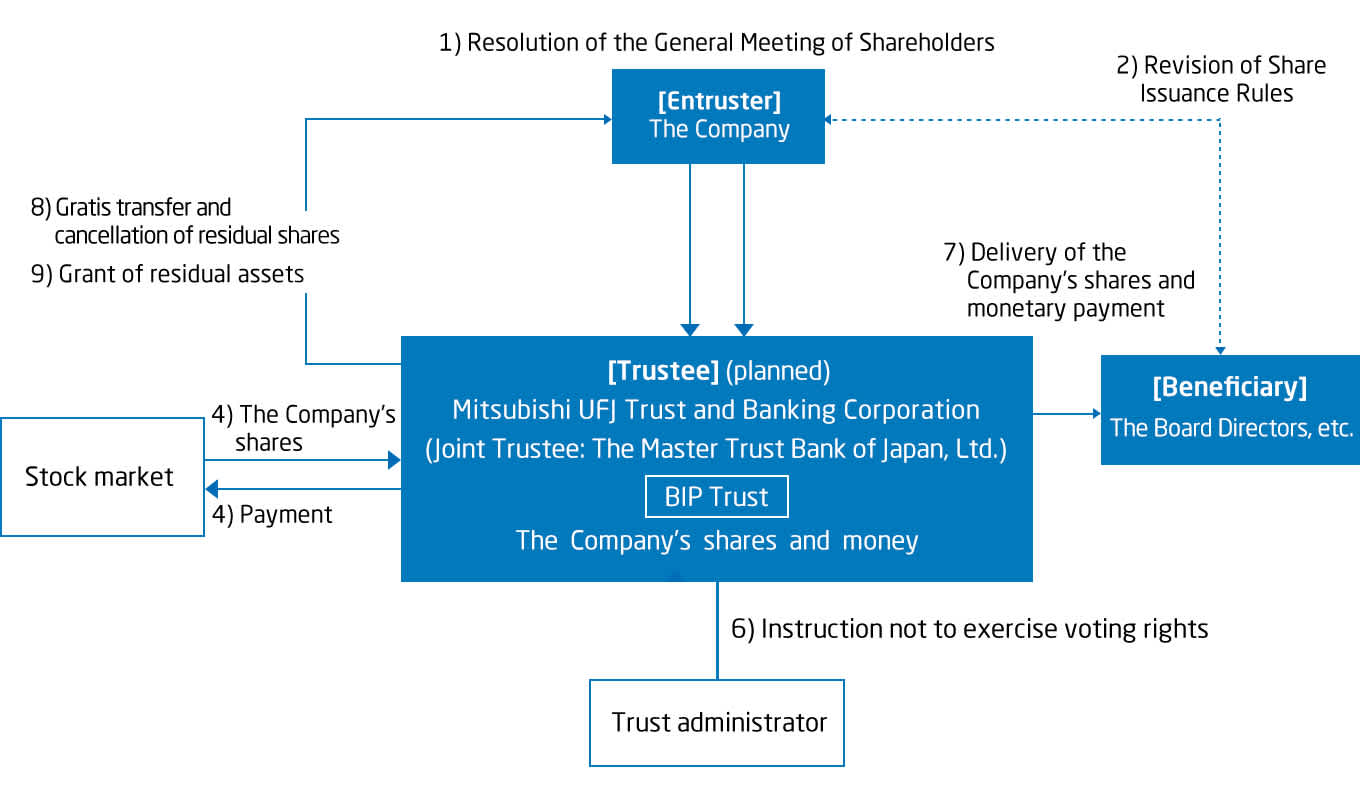

(Reference (1)) Framework of the BIP Trust Structure

1) The Company will obtain approval for the partial revision of the Scheme at the General Meeting.

2) The Company revises the Share Issuance Rules concerning officer remuneration at the Board of Directors meeting.

3) The Company establishes a trust (the "Trust") with certain Board Directors, etc. (the "Subject Persons") who meet the beneficiary requirements as its beneficiaries by entrusting money to the trustee within the limit as approved by the General Meeting in 1) above.

4) The Trust follows the instructions of the trust administrator and acquires the Company's shares from the stock market using the money contributed in 3) above.

5) The Company's shares held in the Trust are entitled to receive dividends in the same manner as other Company's shares.

6) No voting rights shall be exercised on the Company's shares held in the Trust during the trust period.

7) During the trust period, a certain number of points are granted to the Subject Persons according to their individual rank and the level of attainment of performance targets, etc. in the case of performance-based remuneration and/or according to their individual rank, etc. in the case of non-performance based remuneration. The grant, etc. of the Company's shares, etc. corresponding to the number of points is offered to Subject Persons who meet certain beneficiary requirements at the prescribed time.

8) If there are residual shares at the expiry of the trust period, the Company will either continuously use the Trust for the Scheme, or as another incentive plan similar to the Scheme, by amending the trust agreement and additionally contributing to the Trust by the resolution of the Board of Directors, or will transfer the residual shares from the Trust to the Company without compensation, acquire them without compensation, and cancel them by a resolution of the Board of Directors.

9) At the termination of the Trust, residual assets remaining after the distribution to the beneficiaries will be attributable to the Company within the amount of the reserve for trust expenses after deducting share acquisition funds from the trust money. Any portion in excess of the reserve for trust expenses will be donated to organizations with no interest in the Company.

(Note) If the Company's shares are exhausted within the Trust due to the grant, etc. of the Company's shares, etc. to the Board Directors, etc., who meet the beneficiary requirements, the Trust shall be terminated prior to the expiry of the trust period. The Company may additionally entrust money to the Trust as acquisition funds for the Company's shares, thereby causing the Trust to additionally acquire the Company's shares within the limit of the share acquisition funds as well as within the maximum number of shares to be granted as approved by the resolution of the General Meeting of Shareholders.