By offering talent access to money from their weekly pay as they need it, Staffmark Group is creating better results for its clients

For anyone living paycheck to paycheck, money management can be a constant source of stress and worry. Some might struggle to cover essential purchases like food and childcare, while others might be faced with large unexpected expenses they can't afford before payday. To make ends meet, some turn to short-term loans with high interest rates, which puts them into debt and can further exacerbate the problem. US-based staffing and recruitment firm Staffmark Group realized that providing more financial stability to talent could only lead to positive outcomes.

Enhancing lives, enhancing performance

Staffmark Group was founded half a century ago and has over 400 branches and on-site operations across the US and Canada. Throughout its operating history, the company has been driven by its goals to empower people and to always act in a way that creates the best results for its clients and talent. Even before the onset of the COVID-19 pandemic, which created an even more urgent need for a solution, Staffmark Group had begun to consider alternative payment systems. Senior Vice President of Enterprise Operations, Emily Giltner, believed that the solution lay in finding a way to allow people to access money from their weekly paychecks whenever they need it. Emily brought the idea to the executive team, who quickly saw the potential demand for flexible payment as well.

Staffmark Group partnered with US fintech company DailyPay to offer talent real-time access to their earned wages through a mobile app. Emily, the CFO, and multiple teams including Client Services, HR, and IT worked together to roll out the initiative seamlessly using the company's electronic timekeeping solutions.

After a phased launch, the solution proved to be extremely popular and has only grown in importance due to the unprecedented events of 2020. Talent can now access 70% of their earned income on any device at any time. Money can be paid into a bank account or paycard of their choosing, with a minimal transaction fee of less than $3.00. Additionally, talent are able to access a range of budgeting and financial planning tools for free, allowing them to potentially improve their financial stability.

On-demand pay is making a real difference in talent's financial wellbeing and has even led to improved productivity. Around 40% of eligible talent have signed up and collectively transferred nearly $19 million of payroll through the DailyPay option, saving fees and interest fees of up to 400%, annually. Over half of Staffmark Group's new hires have also signed up, making the solution a powerful recruiting tool.

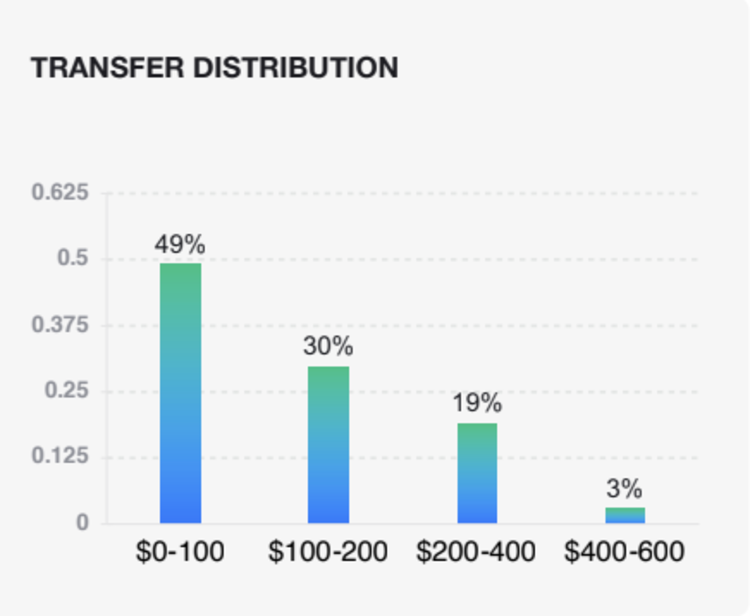

49% of the transfers employees make are of amounts less than $100¹

Spreading the benefits

It is clear the solution is helping talent better manage their daily lives. Staffmark Group found that the average withdrawal amount is $77, which shows that it is being used to help with essential expenses. From allowing people to purchase medicine, diapers, and other day-to-day essentials, to providing people with easy access to gas money so they can get to work, the solution is helping people live with dignity. One quote from an employee on Glassdoor states that the solution has "been awesome to help with Christmas" because they were able to buy presents on time without waiting for the payday. Another employee commented on the survey "I have a very expensive ongoing medical prescription. Without DailyPay, I once would not have been able to purchase it."

For others, the flexible payment solution has been integral to extracting themselves from the vicious cycle of late fees and payday loan interest. Another Glassdoor reviewer stated that they "couldn't be happier doing this instead of taking out a loan and paying the high interest rate." Over 50% of users have also turned to the solution to help cover unexpected expenses relating to COVID-19.

"The solution is fully automated and controllable which eliminates a significant amount of work for us," said Emily. "The participation so far has been amazing, and the results show how socially important it's become."

But this is only the beginning. Staffmark Group plans to make DailyPay available to all of its employees in the coming years - by working with clients to move to automated pay to make this possible . Talent who feel more financially secure and supported are better able to dedicate their energy and passion to their roles, helping to create better results for the business and their clients. By prioritizing social value and putting the needs of its talent first, Staffmark Group is helping to drive positive change with large ripple effects.

¹Staffmark Group, Oct. 2020

Emily Giltner

Senior Vice President - Enterprise Operations, Staffmark Group

Emily graduated from Western Kentucky University with a Bachelor of Science Degree with a major in Finance and a minor in Economics. Additionally, Emily completed her Professional in Human Resources certification in May 2003 and has successfully completed the Certified Staffing Professional, as well as the Certified Search Consultant program through the American Staffing Association. Emily serves on the American Staffing Association Education and Certification Committee and is a past Chairman of the group. Emily was also honored by being chosen to be listed in the Staffing Industry Analysts' 2020 Global Power 150 - Women in Staffing list.