The theme for day 2 of Investor Update FY2023 presented by Recruit Holdings in March 2024 was “Help Businesses Work Smarter” — one of Recruit Group’s three strategic pillars. Matching & Solutions strategic business unit (SBU) leadership spoke about the Group’s progress and outlook through presentations and a fireside chat.

Achieving Higher Revenue Growth and Maximizing Adjusted EBITDA Margins

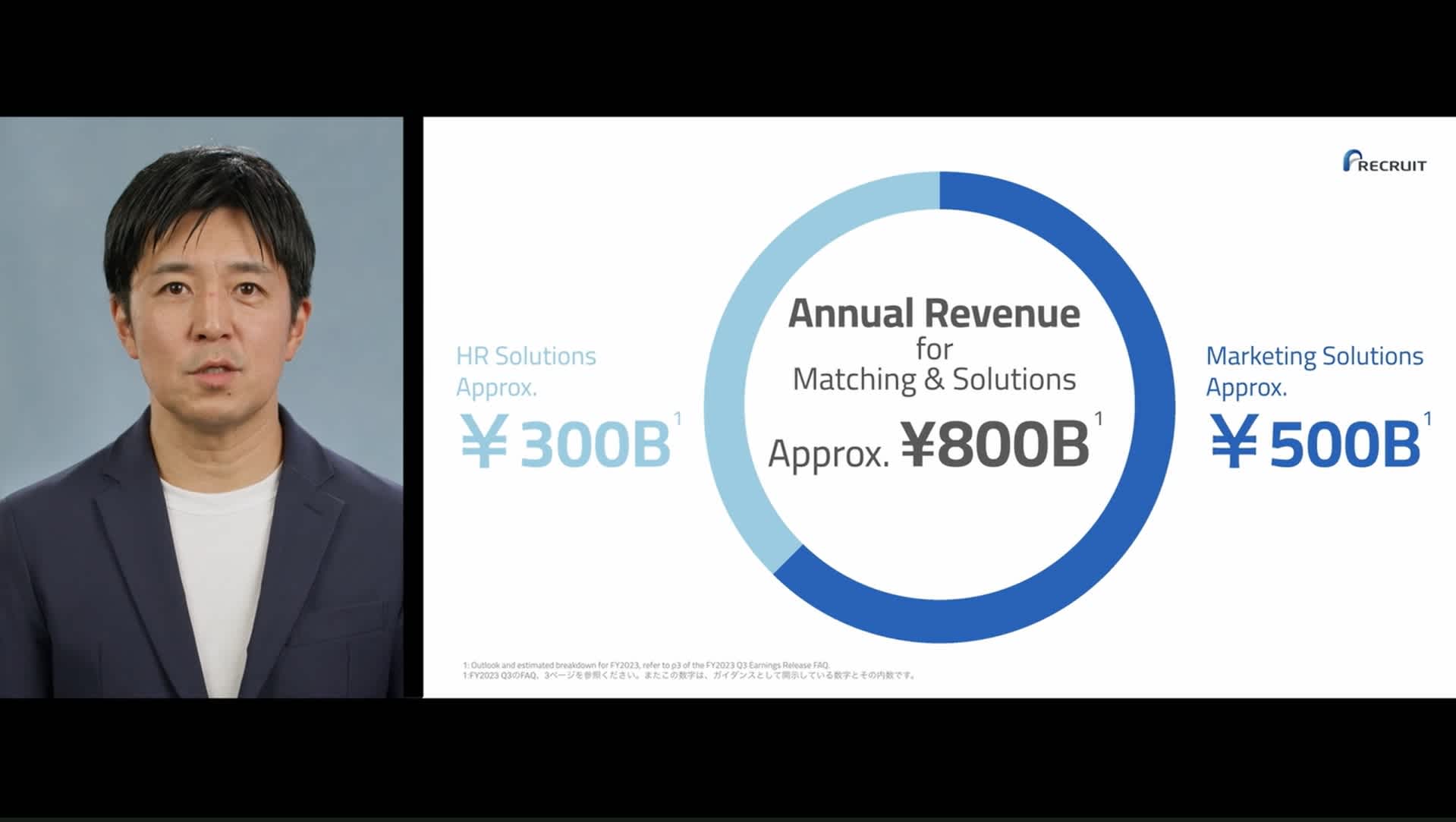

Recruit Holdings Executive Vice President and Matching & Solutions business head Yoshihiro Kitamura started the day off with an update on the progress of our “Help Businesses Work Smarter” strategy and its future leverage points. He first touched on the domain characteristics of the Marketing Solutions business, which is the core of the “Help Businesses Work Smarter” strategy. This strategy targets medium-sized enterprises that tend to be resilient during economic downturns. He then confirmed that the business’s focus is still to maximize the number of actions of individual users by leveraging both online and offline action data and matching technology.

He added that Recruit recognizes that a portion of a business client’s labor and sales administration costs can be replaced by Recruit’s solutions as part of the Total Addressable Market (TAM). That means significant potential for growth remains. He then declared that the Marketing Solutions business aims to maximize adjusted EBITDA margins through revenue growth as well as to drive productivity improvement through operational excellence.

Yoshihiro emphasized the significance of the Marketing Solutions business: “The relationship built with business clients in Marketing Solutions — and information about business clients’ operations acquired through our vertical matching platforms and SaaS solutions — is advantageous for HR matching businesses such as Indeed PLUS (only in Japanese) and the job boards in HR Solutions.” He noted the benefits of having two strategic themes, “Simplify Hiring” and “Help Businesses Work Smarter,” within Matching & Solutions SBU.

Recruit Holdings Executive Vice President and Matching & Solutions head Yoshihiro Kitamura

Four Concrete Measures That Are Key to Implementation

Next up, Jun Akiyama and Keiichi Ushida, executives in charge of product development at Matching & Solutions SBU, explained the following four points as concrete measures for implementation, along with real-life service examples.

Enhancing individual user convenience to increase the number of actions

Increasing available reservation slots, which we call "inventory" on the matching platform, and strengthening client relationships by improving operational efficiency of business clients

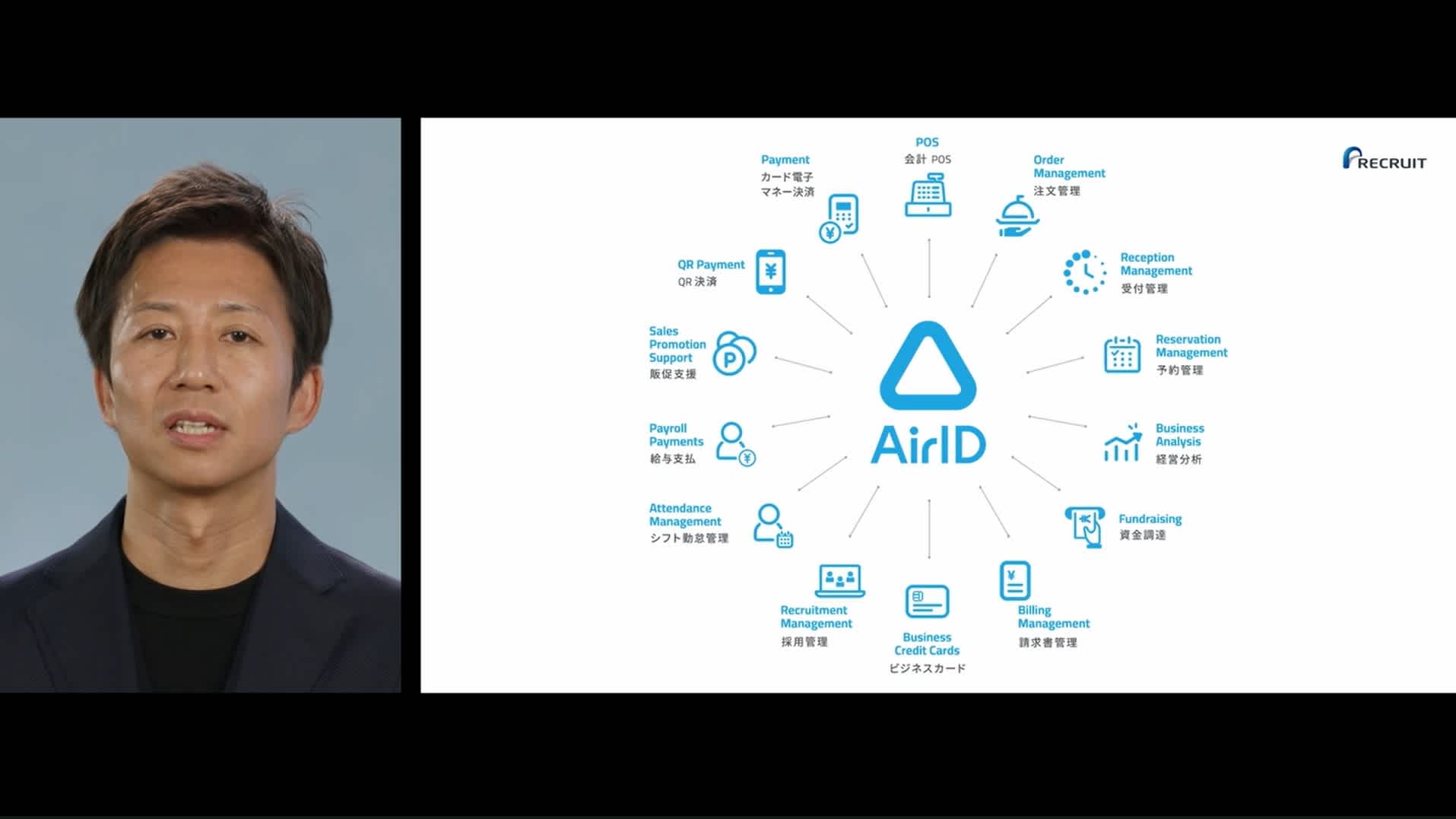

Optimizing acquisition costs for both individual users (Recruit ID) and business clients (Air ID)

Potential of fintech services utilizing payment transaction volumes within AirPAY and AirPAY Online

Jun presented Salon Board in the beauty business and SUUMO Counter in the housing business as prime examples that illustrate the potential. “To solve the fundamental issues faced by individual users and business clients, we are enhancing the value of our matching platforms by utilizing all of our assets, including online and offline services and matching technologies. This evolution is not only happening in housing and real estate, but in other verticals as well.”

Keiichi then shared their future vision: “We will continue to face the challenges of Japan's aging workforce and chronic labor shortages, and that our business support SaaS will help address these challenges. We believe that by providing solutions for business clients that help solve their operational issues, we will continue to expand our client base.”

Jun Akiyama explains the importance of offline activities, using the example of SUUMO Counter, a Recruit service launched in 2005

Keiichi Ushida says: “Air BusinessTools allow you to use 16 services with one ID”

Focus on Creating Better Matches and Better Products to Improve Convenience for Individual Users

After those presentations, Matching & Solutions SBU Executive Vice President of Product Management Ken Asano and Senior Vice Presidentand CHRO in charge of Public Relations and Sustainability Mio Kashiwamura joined Yoshihiro for a fireside chat to answer questions from investors. The following is a digest of key interactions.

ー Can Marketing Solutions grow on a standalone basis?

With the launch of Indeed PLUS in January 2024, sales from the HR business — which was previously within Matching & Solutions SBU — are shifting to HR Technology SBU. Investors’ attention is now focused on the sales growth rate for Marketing Solutions alone and the expected adjustment to EBITDA margins.

Yoshihiro then shared his optimistic view, mentioning that the total number of individual users (with Recruit IDs) and the total number of business users (with AirIDs) are both rising. “We believe we can expand based on these.”

Ken added: “Revenues in Marketing Solutions are structured to be linked to increased profits for business clients. The key is to first boost the number of customers sent to business clients. Then, there is so much more we can do to improve convenience in the business process beyond that.”

He then explained the relationship between pursuing the quantity and quality of actions that lead to sales growth. As a specific example of upgraded convenience, he cited the collaboration between AirREGI and HotPepper Gourmet. “Through this collaboration, we’ve made it possible for customers to make a reservation even one minute before entering a place without business clients having to scramble to manage seating. By boosting customer convenience through constant user experience improvements, we can now assist in business client processes such as pricing. This, in turn, will lead to new monetization and increased profits.”

Regarding internal productivity improvements — which are expected to affect adjusted EBITDA — Mio pointed to signs of improvement in the sales department. “In 2021, we integrated seven companies into one, allowing us to quickly transfer personnel to growing businesses. And whereas several years back one salesperson handled everything from contracts to system implementation and follow-up, we now have task-based organizations. We also recently formed a Client Success Department that spans businesses, enabling us to quickly share best practices with one another.”

Mio also spoke about Recruit’s more robust data infrastructure, which supports sales: “Now we can extract the necessary data in a timely manner to discuss with business clients. The speed of doing so has nearly tripled.”

She added: “As symbolized by our management philosophy of ‘Betting on Passion,’ employees perform best when they do what they want to do. As CHRO, I value this philosophy and try to maximize the value our people create.”

Yoshihiro Kitamura, Mio Kashiwamura, and Ken Asano from Matching & Solutions SBU

ー What kinds of fintech services does Recruit have in mind?

The next question was about specific fintech services Recruit would offer. “Air BusinessTools have been developed with the idea of simplifying or eliminating the hassles associated with business operations,” Yoshihiro replied. “Our fintech services will likely be based on a similar philosophy. In other words, they will be designed to eliminate the hassles associated with money, and will demonstrate their greatest value when used in tandem with other Recruit services, including Air BusinessTools.”

The 90-minute session concluded with this comment from Yoshihiro: “We’re doing a lot of trials with an eye toward the next decade. I hope you look forward with anticipation to the evolution of our services, including fintech.”