Investor Relations

Stock Information

General Stock Information

| Stock Code | 6098 |

|---|---|

| Stock Exchange Registration | Tokyo Stock Exchange Prime Section |

| Fiscal year | From Apr. 1 to Mar. 31 of the next year |

| Base Date | Dividend Payout Interim dividend record date: September 30 Year-end dividend record date: March 31 |

| Number of Shares Constituting One Trading Unit | 100 shares |

| Annual Meeting of Shareholders | Every year in June |

| Administrator of Shareholder Registry | Mitsubishi UFJ Trust and Banking Corporation |

| Share Handling Policy | Share Handling Policy (150KB) |

| Reporting Method | Electronic public notice *However, in the event we are unable to issue an electronic public notice due to an accident or other unavoidable reason, such notices will be published in the Nihon Keizai Shimbun (Nikkei). |

State of Shares and Shareholders

(As of Sep. 30, 2025)

| Number of Shares Authorized | 6,000,000,000 Shares |

|---|---|

| Total Number of Shares Issued | 1,563,912,149 Shares |

(As of Sep. 30, 2025)

| Number of Shareholders | 65,135 Persons |

|---|

Main Shareholders

(As of Sep. 30, 2025)

| Name | Number of shares owned (Thousands) | Shareholding ratio (%) |

|---|---|---|

| The Master Trust Bank of Japan, Ltd. (Trust account) | 277,997 | 18.85 |

| Custody Bank of Japan, Ltd. (Trust account) | 106,072 | 7.19 |

| STATE STREET BANK AND TRUST COMPANY 505001 (Standing proxy: Settlement & Clearing Services Department, Mizuho Bank, Ltd.) |

54,722 | 3.71 |

| GIC PRIVATE LIMITED - C (Standing proxy:MUFG Bank, Ltd.) |

33,129 | 2.24 |

| JP MORGAN CHASE BANK 385632 (Standing proxy: Settlement & Clearing Services Department, Mizuho Bank, Ltd.) |

32,912 | 2.23 |

| STATE STREET BANK WEST CLIENT - TREATY 505234 (Standing proxy: Settlement & Clearing Services Department, Mizuho Bank, Ltd.) |

28,594 | 1.93 |

| Nippon Television Network Corporation | 25,500 | 1.72 |

| The Master Trust Bank of Japan, Ltd. (ESOP Trust account 76576) |

23,745 | 1.61 |

| GOVERNMENT OF NORWAY (Standing proxy:Citibank, N.A., Tokyo Branch) |

23,280 | 1.57 |

| The Master Trust Bank of Japan, Ltd. (ESOP Trust account 76826) |

21,732 | 1.47 |

| Total | 627,686 | 42.58 |

*1 The Company’s treasury stock (89,837,851shares) is excluded in the calculation of the shareholding ratio. Treasury stock does not include the Company’s stock held by the Board Incentive Plan trust (2,918,255 shares) and the equity-settled ESOP trust (50,794,517 shares).

*2 A change report of the Report of Large Volume Holding that was made available for public inspection on September 19, 2025 reports that Sumitomo Mitsui Trust Asset Management Co., Ltd. and its joint holders Amova Asset Management Co., Ltd. hold shares as given below as of July 15, 2020. However, their holdings are not reflected in the status of major shareholders above since the Company was not able to confirm beneficial ownership or the number of shares held as of September 30, 2025.

Overview of the change report is as follows.

| Name | Number of shares owned (Thousands) | Shareholding ratio (%) |

|---|---|---|

| Sumitomo Mitsui Trust Asset Management Co., Ltd. | 49,088 | 3.14 |

| Amova Asset Management Co., Ltd. | 39,492 | 2.53 |

| Total | 88,580 | 5.66 |

*3 A change report of the Report of Large Volume Holding that was made available for public inspection on July 21, 2020 reports that Nomura Securities Co., Ltd. and its joint holders NOMURA INTERNATIONAL PLC and Nomura Asset Management Co., Ltd. hold shares as given below as of July 15, 2020. However, their holdings are not reflected in the status of major shareholders above since the Company was not able to confirm beneficial ownership or the number of shares held as of September 30, 2025.

Overview of the change report is as follows.

| Name | Number of shares owned (Thousands) | Shareholding ratio (%) |

|---|---|---|

| Nomura Securities Co., Ltd. | 2,572 | 0.15 |

| NOMURA INTERNATIONAL PLC | 1,812 | 0.11 |

| Nomura Asset Management Co., Ltd. | 83,182 | 4.90 |

| Total | 87,567 | 5.16 |

*4 A change report of the Report of Large Volume Holding that was made available for public inspection on April 3, 2025 reports that BlackRock Japan Co., Ltd. and its joint holders BlackRock Advisers, LLC,BlackRock Financial Management, Inc., BlackRock (Netherlands) BV, BlackRock Fund ManagersLimited, BlackRock Asset Management Canada Limited, BlackRock Asset Management Ireland Limited, BlackRock Fund Advisors, BlackRock Institutional Trust Company, N.A., and BlackRock Investment Management (UK) Limited hold shares as given below as of March 31, 2025. However, their holdings are not reflected in the status of major shareholders above since the Company was not able to confirm beneficial ownership or the number of shares held as of September 30, 2025.

Overview of the change report is as follows.

| Name | Number of shares owned (Thousands) | Shareholding ratio (%) |

|---|---|---|

| BlackRock Japan Co., Ltd. | 34,489 | 2.21 |

| BlackRock Advisers, LLC | 2,848 | 0.18 |

| BlackRock Financial Management, Inc. | 1,740 | 0.11 |

| BlackRock (Netherlands) BV | 5,168 | 0.33 |

| BlackRock Fund Managers Limited |

4,514 | 0.29 |

| BlackRock Asset Management Canada Limited | 2,301 | 0.15 |

| BlackRock Asset Management Ireland Limited | 10,663 | 0.68 |

| BlackRock Fund Advisors | 28,117 | 1.80 |

| BlackRock Institutional Trust Company, N.A. |

20,456 | 1.31 |

| BlackRock Investment Management (UK) Limited |

2,046 | 0.13 |

| Total | 112,347 | 7.18 |

*5 A change report of the Report of Large Volume Holding that was made available for public inspection on March 24, 2025 reports that Capital Research and Management Company and its joint holder Capital International Inc. hold shares as given below as of March 14, 2025. However, their holdings are not reflected in the status of major shareholders above since the Company was not able to confirm beneficial ownership or the number of shares held as of September 30, 2025.

Overview of the change report is as follows.

| Name | Number of shares owned (Thousands) | Shareholding ratio (%) |

|---|---|---|

| Capital Research and Management Company |

66,223 | 4.01 |

| Capital International Inc. | 2,126 | 0.13 |

| Total | 68,350 | 4.14 |

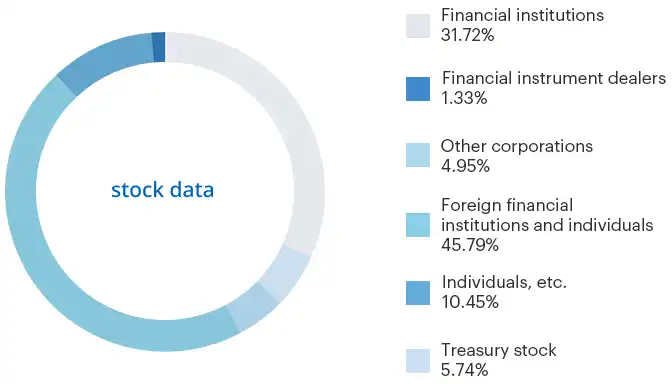

Classification by Type of Shareholder

(As of Sep. 30, 2025)

| Category | Number of shares | Ratio of shares owned |

|---|---|---|

| Financial institutions | 496,186,080 Shares | 31.72% |

| Financial instrument dealers | 20,873,243 Shares | 1.33% |

| Other corporations | 77,390,007 Shares | 4.95% |

| Foreign financial institutions and individuals | 716,180,998 Shares | 45.79% |

| Individuals, etc. | 163,443,970 Shares | 10.45% |

| Treasury stock | 89,837,851 Shares | 5.74% |

| Shareholder registry administrator | Mitsubishi UFJ Trust and Banking Corporation |

|---|---|

| Contact | Corporate Agency Division Tel: 0120-232-711 (toll free) Reception hours: 9 a.m to 5 p.m (excluding weekends and holidays) (Japanese only) https://www.tr.mufg.jp/daikou/ (Japanese only) |