Newsroom

- IR

Recruit Holdings Co., Ltd. Announces the Implementation of the Stock Incentive Plan for the Board Directors, etc. of the Company and the Subsidiary

May 15, 2018

TOKYO, JAPAN (May 15, 2018) -Recruit Holdings Co., Ltd. (TSE 6098) (the "Company") announces that its Board of Directors meeting determined today the details of the stock incentive plan (the "Scheme") to be implemented in May 2018 for the Board Directors, Corporate Executive Officers and Corporate Professional Officers (hereinafter collectively referred to as the "Board Directors, etc.") of the Company and its subsidiary (the "Subject Companies")

1. Details of the Scheme

(1) The Scheme is an incentive plan, which is a stock incentive plan the Company has introduced in 2016 for its Board Directors, etc. and has resolved its introduction for the Board Directors, etc. of the subsidiary on February 27, 2018.

(*) In regard to the stock incentive plan for Board Directors, etc. of the Company, please refer to the "Notification of Introduction of the Performance-based Stock Incentive Plan for Board Directors" disclosed on May 13, 2016.

(*) In regard to the stock incentive plan for Board Directors, etc. of the subsidiary, please refer to "Recruit Holdings Co., Ltd. Announces Introduction of the Performance-based Stock Incentive Plan for Subsidiary Board Directors, etc." disclosed on February 27, 2018.

(2) The Scheme adopts the structure used for the Board Incentive Plan Trust (the "BIP Trust"). The BIP Trust is a stock incentive plan in which the Company's shares are acquired through a trust using the funds contributed by the Subject Companies as remuneration for Board Directors, etc., and a grant or payment (the "grant, etc.") of the Company's shares and money equivalent to the converted value of such shares (the "Company's shares, etc.") are offered to Board Directors, etc. at time of retirement in principle, according to their individual rank and the level of attainment of performance targets etc.

(3) The Subject Companies of the Scheme for the current fiscal year is namely the Company and Recruit Co., Ltd., a subsidiary of the Company. The introduction of the Scheme was approved at the general meeting of shareholders of the Company held on June 21, 2016 and of Recruit Co., Ltd. held on today.

(4) The Subject Companies intend to continuously implement the Scheme by newly establishing trusts, or by making amendments to the existing trusts after the expiry of the trust period and making additional contribution to such existing trusts, each year from the next fiscal year onward.

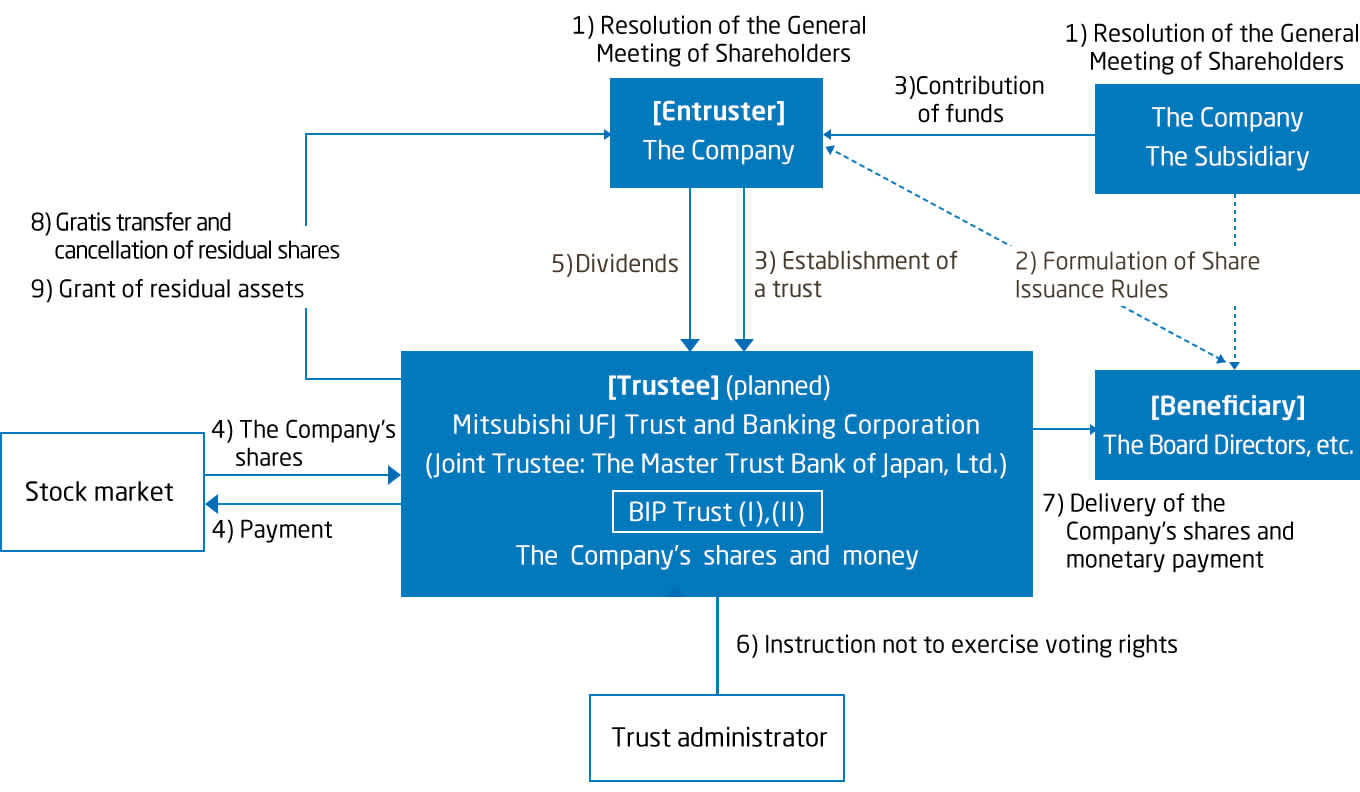

2. Framework of the Scheme

1) The Subject Companies obtained approval for the introduction of the Scheme for the Board Directors, etc. at the general meeting of shareholders of each company.

2) The Subject Companies establish the Share Issuance Rules at the board of directors meeting with respect to the introduction of the Scheme.

3) The Company entrusts money which the Company contributed as stock compensation and the money contributed by the subsidiary to the trustee, and establishes the Trust BIP(I) and Trust BIP(II) (hereinafter collectively referred to as the "Trusts"). The Trust BIP(I) is for the Board Directors, etc. of the Company who meet the beneficiary requirements as its beneficiary and the Trust BIP(II) is for the Board Directors, etc. of the subsidiary who meet the beneficiary requirements as its beneficiary. The Subject Companies are allowed to contribute money within the limit as approved by the general meeting of shareholders in 1).

4) The Trusts follow the instruction of the trust administrator and acquire the Company's shares from the stock market using the money contributed in 3).

5) The Company's shares held in the Trusts are entitled to receive dividends in the same manner as other Company's shares.

6) No voting rights shall be exercised on the Company's shares held in the Trusts during the trust period.

7) During the trust period, a certain number of points are granted to the Board Directors, etc. according to their individual rank and the level of attainment of performance targets, etc. The grant, etc. of the Company's shares, etc. corresponding to the number of points are offered to the Board Directors, etc. who meet certain beneficiary requirements, in principle, at the time of their retirement. (The Board Directors, etc. are, in principle, granted 50% of the Company's shares corresponding to the points (fractional shares are omitted) in accordance with the provisions of the trust agreement, while the remaining Company's shares corresponding to the points are converted to money within the Trusts and paid to the Board Directors, etc. in money.)

8) If there are residual shares at the expiry of the trust period, the Subject Companies will either continuously use the Trusts for the Scheme, or as another incentive plan similar to the Scheme, by amending the trust agreement by the resolution of the Board of Directors and having additionally contribute to the Trusts, or will transfer the residual shares from the Trusts to the Company without compensation, acquire them without compensation, and cancel them by a resolution of the Board of Directors.

9) At the termination of the Trusts, residual assets remaining after the distribution to the beneficiaries will be attributable to the Subject Companies within the amount of the reserve for trust expenses after deducting share acquisition funds from the trust money. Any portion in excess of the reserve for trust expenses will be donated to organizations with no interest in the Subject Companies.

(Note) If the Company's shares are exhausted within the Trusts due to the grant, etc. of the Company's shares, etc. to the Board Directors, etc., who meet the beneficiary requirements, the Trusts shall be terminated prior to the expiry of the trust period. The Company may entrust money to the Trusts and the subsidiary may additionally entrust money to the Trusts through the Company as acquisition funds for the Company's shares, thereby causing the Trusts to additionally acquire the Company's shares within the limit of the share acquisition funds as well as within the maximum number of shares to be granted as approved by the resolution of the General Meeting of Shareholders.

3. Outline of the trust agreement

| BIP(I) (the Company) | BIP(II) (the subsidiary) | ||

|---|---|---|---|

| 1) | Type of trust | Monetary trust other than a specified solely-administered monetary trust (third-party benefit trust) | |

| 2) | Purpose of trust | Providing incentive to the following subject persons | |

| 3) | Subject persons | The Board Directors, etc. of the Company | The Board Directors, etc. of the subsidiary |

| 4) | Entruster | The Company | |

| 5) | Trustee | Mitsubishi UFJ Trust and Banking Corporation (planned)(Joint Trustee: The Master Trust Bank of Japan, Ltd.) | |

| 6) | Beneficiary | The Board Directors, etc. who meet the beneficiary requirements | |

| 7) | Trust administrator | A third party with no interest in the Company | |

| 8) | Date of trust agreement | May 17, 2018 (planned) | |

| 9) | Trust term | May 17, 2018 (planned) to August 31, 2021 (planned) | |

| 10) | Commencement date of the scheme | May 17, 2018 (planned) | |

| 11) | Exercise of voting rights | Voting rights will not be exercised. | |

| 12) | Class of shares to be acquired | Common stock of the Company | |

| 13) | Amount of trust | ¥1.1 billion (planned) | ¥0.1 billion (planned) |

| (each including trust fees and trust expenses) | |||

| 14) | Timing for acquiring shares | May 18, 2018 (planned) to June 18, 2018 (planned) | |

| 15) | Method of share acquisition | Acquisition from the stock market | |

| 16) | Rights holder | The Company | |

| 17) | Residual assets | The Company, as the rights holder, may receive residual assets within the scope of reserve for trust expenses after deducting share acquisition fund from trust money. | |

(Note) The scheduled dates mentioned above may be changed to appropriate dates in light of applicable laws and regulations.

[Details of administration relating to the trusts and shares]

| 1) | Trust-related administration | Mitsubishi UFJ Trust and Banking Corporation and The Master Trust Bank of Japan, Ltd. are to be the trustees of the Trusts and will conduct trust-related administration. |

|---|---|---|

| 2) | Share-related administration | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. will conduct administration related to the delivery of the Company's shares to beneficiaries based on the administration service agreement. |