Newsroom

- IR

Q2 FY2019 Financial Results

Nov 13, 2019

TOKYO, JAPAN (November 13, 2019) - Recruit Holdings Co., Ltd. ("Recruit Holdings" or the "Company") today announced financial results for the six months ended September 30, 2019 (unaudited).

1. 6 Months FY2019 Consolidated Financial Highlights

Consolidated revenue +5.1%, Adjusted EBITDA +14.5%, Adjusted EPS +15.9%

Revenue and adjusted EBITDA increased in HR Technology and Media & Solutions segments.

Revenue and adjusted EBITDA decreased in Staffing segment impacted by uncertain economic environment in Europe.

HR Technology segment continued its strong growth

Revenue increased +37.8% yoy, +40.1% in US dollar terms*²

(In billion yen, unless otherwise stated)

| FY2019 | ||||

|---|---|---|---|---|

| Q2 | YoY | 6M | YoY | |

| Revenue | 606.7 | +5.0% | 1,201.2 | +5.1% |

| Adjusted EBITDA*¹ | 90.3 | +18.1% | 177.7 | +14.5% |

| Adjusted EBITDA margin*¹ | 14.9 % | +1.7 pt | 14.8% | +1.2pt |

| Operating income | 71.4 | +21.6% | 142.6 | +12.7% |

| Profit attributable to owners of the parent |

54.8 | +21.0% | 114.1 | +23.2% |

| Adjusted EPS (yen) | 34.67 | +18.5% | 67.96 | +15.9% |

2. Q2 FY2019 Segment Highlights

HR Technology Segment:

Quarterly revenue for Q2 FY2019 increased by 29.6% yoy (year on year) and by 34.8%*² yoy in US dollar terms*²; revenue growth was primarily driven by increased sponsored job advertising revenue. Recruiting solutions focused on sourcing and screening candidates and employer branding also contributed to revenue growth yoy.

Slower revenue growth compared to yoy 47.5% of Q1 FY2019 was in part due to the absence of acquired revenue growth related to the Glassdoor acquisition, which was included since Q2 FY2018.

Quarterly adjusted EBITDA for Q2 FY2019 increased by 70.5% yoy. Adjusted EBITDA margin was 22.9% for Q2 FY2019, an increase from 17.4% for Q2 FY2018 primarily due to lower growth in sales and marketing expenses compared to the pace of revenue growth.

As of Q2 FY2019, Indeed and Glassdoor attract more than 250 million and 60 million monthly unique visitors*³ and had approximately 9,700 and 1,000 employees, respectively.

Media & Solutions Segment:

Quarterly revenue for Q2 FY2019 increased by 8.3% yoy, primarily driven by increased revenue in the Housing and Real Estate, Travel and Beauty subsegments in Marketing Solutions and in the Recruiting in Japan subsegment in HR Solutions.

Quarterly adjusted EBITDA for Q2 FY2019 increased by 8.8% yoy due to increased revenue in both Marketing Solutions and HR solutions.

Housing and Real Estate focused on improving the user experience on its online platform and attracting more individual users to the platform by various marketing efforts.

Beauty continued to extend its reach to non-urban areas and the outskirts of metropolitan areas.

Travel revised its online booking fee on its platform Jalan from April 1, 2019, which contributed to revenue growth despite the negative impact of less than normal traveling demand during the summer due to the 10 consecutive-day holiday in May in Japan and frequent bad weather.

Recruiting in Japan focused on strengthening its organizational structure to improve productivity amid the extremely tight labor market in Japan.

Staffing Segment:

Quarterly revenue for Q2 FY2019 decreased by 2.6% (ex FX impact: +1.7%). Quarterly revenue for Japan operations increased by 5.5% and for Overseas operations decreased by 8.0% (ex FX impact: -1.0%) yoy.

Quarterly adjusted EBITDA for Q2 FY2019 increased by 5.0% (Japan +20.4%, Overseas -8.7%) yoy. Adjusted EBITDA margin for Q2 FY2019 was 6.7%.

For Japan operations, quarterly adjusted EBITDA increased mainly due to increased revenue. Adjusted EBITDA margin was 8.2%, increased from 7.2% for Q2 FY2018.

For Overseas operations, quarterly revenue and adjusted EBITDA for Q2 decreased in the current uncertain economic environment mainly in Europe. Adjusted EBITDA margin remained flat yoy at 5.5% in Q2 FY2018. The segment continues to focus on utilizing the Unit Management System to optimize its adjusted EBITDA margin.

Revenue

Revenue (In billion yen)

| FY2018 | FY2019 | ||||

|---|---|---|---|---|---|

| Q2 | Q2 | YoY | 6M | YoY | |

| Consolidated results*⁴ | 577.8 | 606.7 | +5.0% | 1,201.2 | +5.1% |

| HR Technology | 82.4 | 106.8 | +29.6% | 209.0 | +37.8% |

| Reference:(In million US dollars) Revenue in US dollars*² |

739 | 996 | +34.8% | 1,925 | +40.1% |

| Media & Solutions | 175.8 | 190.5 | +8.3% | 378.2 | +8.2% |

| Marketing Solutions | 100.8 | 110.6 | +9.7% | 216.3 | +11.3% |

| Housing and Real Estate | 25.2 | 27.5 | +9.2% | 54.3 | +9.8% |

| Bridal | 13.8 | 13.1 | -5.0% | 26.4 | -4.7% |

| Travel | 17.6 | 21.3 | +20.8% | 38.8 | +22.7% |

| Dining | 9.2 | 9.3 | +1.1% | 18.8 | +2.1% |

| Beauty | 17.8 | 20.2 | +13.8% | 39.6 | +13.3% |

| Others | 16.9 | 18.9 | +11.4% | 38.1 | +19.1% |

| HR Solutions | 74.4 | 79.2 | +6.5% | 160.3 | +4.5% |

| Recruiting in Japan | 66.4 | 70.0 | +5.3% | 141.9 | +3.8% |

| Others | 7.9 | 9.2 | +15.9% | 18.4 | +9.9% |

| Eliminations and Adjustments | 0.6 | 0.6 | +1.5% | 1.4 | -0.8% |

| Staffing | 325.8 | 317.5 | -2.6% | 630.1 | -3.8% |

| Japan | 132.5 | 139.8 | +5.5% | 277.5 | +3.5% |

| Overseas | 193.2 | 177.7 | -8.0% | 352.5 | -8.8% |

| Eliminations and Adjustments | (6.2) | (8.0) | - | (16.1) | - |

Adjusted EBITDA

(In billion yen)

| FY2018 | FY2019 | ||||

|---|---|---|---|---|---|

| Q2 | Q2 | YoY | 6M | YoY | |

| Consolidated results*¹ *⁴ | 76.5 | 90.3 | +18.1% | 177.7 | +14.5% |

| HR Technology*¹ | 14.3 | 24.4 | +70.5% | 43.7 | +84.1% |

| Media & Solutions*¹ | 44.0 | 47.9 | +8.8% | 98.0 | +7.3% |

| Marketing Solutions*¹ *⁵ | 29.7 | 31.3 | +5.2% | 62.1 | +7.6% |

| HR Solutions*¹ *⁵ | 18.1 | 21.3 | +17.7% | 44.9 | +8.1% |

| Eliminations and Adjustments*¹ *⁵ | (3.8) | (4.7) | - | (8.9) | - |

| Staffing*¹ | 20.1 | 21.1 | +5.0% | 40.9 | -7.3% |

| Japan*¹ | 9.5 | 11.4 | +20.4% | 23.2 | +1.2% |

| Overseas*¹ | 10.6 | 9.6 | -8.7% | 17.7 | -16.4% |

| Eliminations and Adjustments*¹ | (1.9) | (3.0) | - | (5.0) | - |

Adjusted EBITDA margin |

|||||

| Consolidated results*¹ | 13.2% | 14.9% | +1.7pt | 14.8% | +1.2pt |

| HR Technology | 17.4% | 22.9% | +5.5pt | 20.9% | +5.3pt |

| Media & Solutions*¹ | 25.0% | 25.2% | +0.1pt | 25.9% | -0.2pt |

| Marketing Solutions*¹ *⁵ | 29.5% | 28.3% | -1.2pt | 28.7% | -1.0pt |

| HR Solutions*¹ *⁵ | 24.4% | 27.0% | +2.6pt | 28.0% | +0.9pt |

| Staffing*¹ | 6.2% | 6.7% | +0.5pt | 6.5% | -0.2pt |

| Japan*¹ | 7.2% | 8.2% | +1.0pt | 8.4% | -0.2pt |

| Overseas*¹ | 5.5% | 5.5% | -0.0pt | 5.0% | -0.5pt |

*1 EBITDA and EBITDA margin for Q2 FY2018, adjusted EBITDA and adjusted EBITDA margin for Q2 FY2019

*2 The US dollar based revenue reporting represents the financial results of operating companies in this segment on a US dollar basis, which differ from the consolidated financial results of the Company.

*3 Source: Internal data based on Google Analytics service, Q2 FY2019.

*4 The total sum of the three segments does not correspond with consolidated numbers due to Eliminations and Adjustments, such as intra-group transactions.

*5 For Q2 FY2019, the segment profit of some subsidiaries in Marketing Solutions and HR Solutions is not adjusted for the impact of the adoption of IFRS 16. The effect of this is not material and such amount is included in Eliminations and Adjustments.

3. Consolidated Financial Guidance for FY2019

There is no revision of consolidated financial guidance for FY2019 from the figures announced on May 14, 2019.

The Company expects that the incident related to Rikunabi DMP Follow will not have a significant impact to the Company's consolidated financial results for FY2019.

For FY2019, the Company expects:

- Revenue and adjusted EBITDA for all three segments to increase

- Adjusted EBITDA to be in the range of 310 billion yen to 330 billion yen

- Adjusted EPS to grow high single digits

The HR Technology segment revenue on a US dollar basis is expected to grow approximately 35% plus or minus a few percent. Adjusted EBITDA margin for the segment is expected to be approximately the same level as FY2018 plus or minus a few percent mainly due to continued investment in sales and marketing activities to acquire new users and clients and in product enhancements to increase user and client engagement.

The Media & Solutions segment revenue is expected to continue stable growth. Revenue for Marketing Solutions is expected to grow mid single digits, and revenue for HR Solutions is expected to grow low single digits. Adjusted EBITDA margin for the segment is expected to remain at a level similar to that of FY2018.

The Staffing segment revenue is expected to increase low single digits (Japan operation to increase, and Overseas operations to decrease), and adjusted EBITDA margin for the Staffing segment to improve slightly for FY2019.

4. Media & Solutions - Introduction to Air BusinessTools

1. Air BusinessTools is collectively renamed from AirSeries.

2. RPA indicates "Robotics Process Automation."

We will strengthen these SaaS products to be a growth pillar in the Media & Solutions segment in the future, in addition to the advertising business.

We have multiple services in Air BusinessTools, including a reservation management system, a CRM which supports marketing activities, and a POS function, AirREGI, which have experienced strong growth in the number of accounts. Going forward, we are focused on expanding the number of transactions through the other services as well, including AirPAY which is a payment function and AirSHIFT, an attendance management tool.

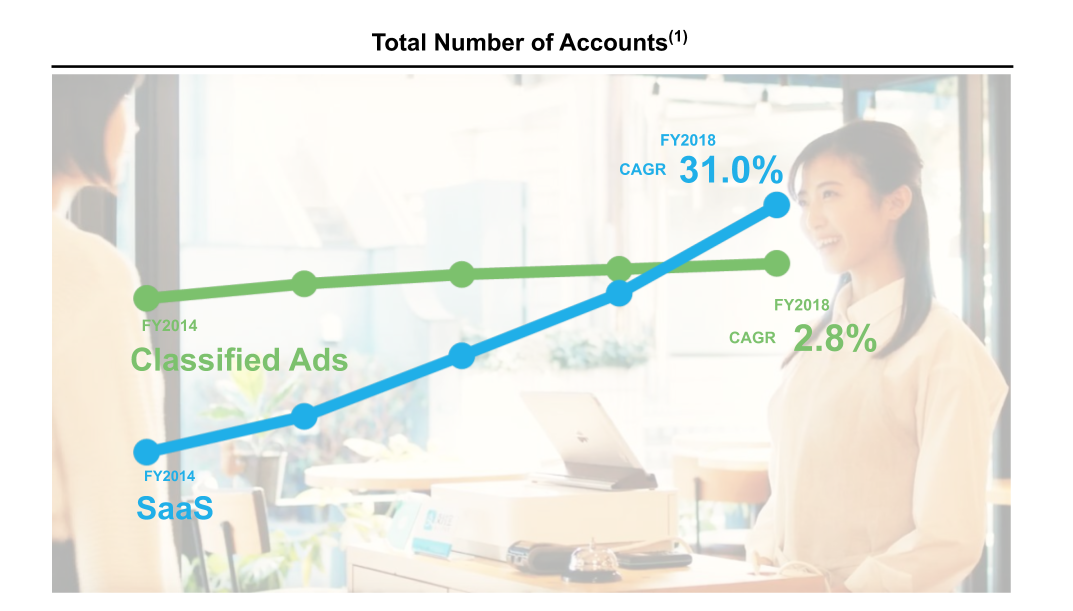

1. Registered accounts for SaaS include multiple accounts of the same enterprise clients including SMEs for different types of SaaS solutions offered mainly through Air BusinessTools. The accounts of classified ads and SaaS include the freemium users. The accounts are as of fiscal year end.

The number of our SaaS accounts has grown quickly, with a 5-year growth rate of 31.0%, and already exceeds that of our Classified Ads accounts.

We aim to increase the total number of SaaS accounts by attracting new clients to Air BusinessTools.

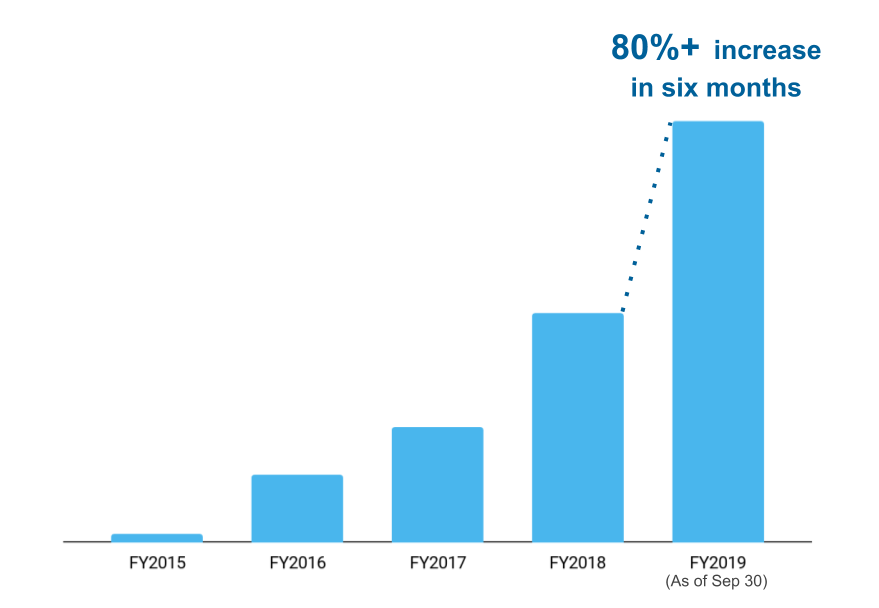

1. The accounts are as of fiscal year end for FY2015 to FY2018 and as of the end of September 2019 for FY2019.

Thanks to the recent measures to promote cashless payments by the government, growth in the number of accounts for payment service, AirPAY in the Air BusinessTools suite, has been particularly strong.

This chart shows the growth in the number of AirPAY accounts.

Please forgive the detailed figures, but recently, the number of accounts has increased considerably by more than 80% in the six months from the end of March to the end of September 2019.

In addition, even after the consumption tax hike was enforced on October 1, 2019, we've continued to see high demand for new AirPAY accounts from SMEs, and we expect this demand to continue for some time.

Going forward, we aim to grow our SaaS business with new clients who have not previously utilized our advertising services, by focusing on AirPAY and AirREGI, which has approximately 450 thousand accounts already.

5. FAQ's

As used herein, the "Company" refers to Recruit Holdings Co., Ltd. and the "Group" refers to the Company and its consolidated subsidiaries unless the context indicates otherwise.

Consolidated Results

Q1:

Why did operating profit increase 21.6% year on year, while consolidated revenue increased 5.0% year on year?

A1:

Mainly because the revenue from the HR Technology and the Media & Solutions, which have higher profitability than Staffing, increased.

Q2:

Why did comprehensive income for the six-months period decrease 30.3%?

A2:

It was mainly due to a decrease in exchange differences on translation of foreign operations * of 26.3 billion yen, resulting from the foreign exchange rate movements, particularly related to the stronger yen.

* Currency translation adjustments

HR Technology

Q3:

Why did revenue on a US dollar basis * increase 34.8% year on year? Why was the revenue growth rate lower compared to 46.3% in Q1 FY2019?

A3:

Revenue growth was primarily driven by increased sponsored job advertising, which continued to be supported by a generally favorable economic environment and tight labor market, especially in the US and Japan. Also contributing to revenue growth year over year were Indeed and Glassdoor recruiting solutions focused on sourcing and screening candidates and employer branding.

The USD dollar basis revenue growth was slower compared to Q1 FY2019 primarily due to the absence of acquired revenue growth related to the Glassdoor acquisition.

* The US dollar based revenue reporting represents the financial results of operating companies in this segment on a US dollar basis, which differ from the consolidated financial results of the Company.

Q4:

What is the split of revenue between US vs Non-US for the HR Technology segment and what was the difference in revenue growth rate?

A4:

The Company discloses the breakdown of its revenue by regions only for the full-year results.

In FY2018, non-US revenue approached approximately 30% of the total revenue of the HR Technology segment, and we expect this proportion to gradually increase over the long term.

In Q2 FY2019, the HR Technology segment continued to achieve strong revenue growth in the US and Non-US operations.

Q5:

Why did adjusted EBITDA margin increase year on year to 22.9%?

A5:

Adjusted EBITDA margin expansion in Q2 FY2019 was primarily due to lower growth in sales and marketing expenses compared to revenue growth. To support future revenue growth, the HR Technology segment also invested heavily in product enhancements to increase user and client engagement. The timing of these investments will fluctuate on a quarterly basis.

The focus is on growing market share and revenue growth, not margin expansion. Adjusted EBITDA margin for FY2019 is expected to be approximately the same level of FY2018, plus or minus a few %.

Q6:

How many unique visitors did Indeed and Glassdoor have? Please also provide an update on the number of employees.

A6:

As of Q2 FY2019, Indeed and Glassdoor attracted more than 250 million and 60 million monthly unique visitors, respectively. As of the end of Q2 FY2019, Indeed and Glassdoor had approximately 9,700 and 1,000 employees, respectively.

Media & Solutions

Q7:

Why did revenue and adjusted EBITDA in Marketing Solutions increase 9.7% and 5.2% year on year, respectively?

A7:

Revenue growth was primarily driven by increased revenue in the Housing and Real Estate, Travel and Beauty subsegments. Adjusted EBITDA growth was primarily due to the increased revenue.

Q8:

Why did quarterly revenue in the Housing and Real Estate subsegment increase 9.2% year on year?

A8:

Revenue growth was primarily a result of continued improvements in the user experience on its online platform, marketing efforts to attract more individual users to the platform, and sales initiatives to offer operational and management solutions to enterprise clients.

Q9:

Why did quarterly revenue in the Travel subsegment increase 20.8% year on year?

A9:

Revenue increased mainly due to revise online booking fees of the online reservation platform, Jalan, effective from April 1, 2019, despite the negative impact from less than normal traveling demand during the summer due to the 10 consecutive-day holiday in May in Japan and frequent bad weather.

Q10:

Why did revenue and adjusted EBITDA in HR Solutions increase 6.5% and 17.7% year on year, respectively?

A10:

Revenue increased as a result of solid performance particularly in the placement business in the Recruiting in Japan subsegment, against the backdrop of the extremely tight Japanese labor market, in which the subsegment focused on strengthening its organizational structure to improve productivity.

Adjusted EBITDA growth was primarily due to the increased revenue, and lower advertising expenses compared to Q2 FY2018.

Q11:

The revenue growth rate in the Recruiting in Japan subsegment was 5.3% in Q2. What was the revenue growth rate excluding one time factors such as a sale of subsidiaries?

A11:

The sale of two subsidiaries in August 2018 and April 2019 impacted revenue growth in the Recruiting in Japan subsegment. Excluding the impact, revenue increased 6.8% year on year.

Staffing

Q12:

Why did revenue in Japan operations increase 5.5% year on year?

A12:

The Japanese labor market remained tight, and in this market the number of active agency workers remained at a high level, growing 2.1% year on year in the three months from April to June 2019, based on the most recently available data from the Japan Staffing Services association, indicating continued strong demand for agency workers. In this environment, Japan operations focused on increasing the number of registered agency workers and new staffing contracts. As a result, revenue increased year on year.

Q13:

Why did adjusted EBITDA margin in Japan operations increased to 8.2% in Q2 FY2019, from 7.2% in Q2 FY2018?

A13:

This was mainly due to the absence of the one-off expenses related to abnormally high holiday pay in Q2 FY2018, accompanied by the Revised Worker Dispatching Act in Japan, and the lower growth rate of advertising expense to grow the number of registered agency workers compared to the revenue growth rate.

Adjusted EBITDA in Japan operations increased by 20.4% year on year.

Q14:

Why did revenue in Overseas operations decrease 8.0% year on year?

A14:

Revenue decreased primarily due to an uncertain outlook for the European economy. The negative impact of foreign exchange rate movements on revenue was 13.6 billion yen. Excluding this impact, revenue decreased 1.0% year on year.

Q15:

What is the outlook for adjusted EBITDA margin going forward, as is was flat at 5.5% in Q2 FY2019, compared to Q2 FY2018?

A15:

With the current uncertain economic environment in certain European countries, the Staffing segment aims to optimize its adjusted EBITDA margin by improving cost efficiency by reducing administration costs, integrating some branches and optimizing personnel allocation, while continuing to focus on utilizing the Unit Management System.

Rikunabi DMP Follow

Q16:

The Company received several directives regarding Rikunabi DMP Follow service from regulators. What are the actions the Company has taken so far?

A16:

The Company takes the administrative admonishment and administrative directive from the Personal Information Protection Commission and the administrative directive from the Tokyo Labor Bureau very seriously. The Company is taking various measures by instructing and supervising Recruit Co., Ltd ("Recruit"), the headquarters of Media & Solutions segment, and Recruit Career Co., Ltd ("Recruit Career"), the subsidiary of Recruit, and the operating company of RIkunabi DMP Follow.

For example, the Company has instructed Recruit to establish a standardized multi-check process for all products and services, to integrate the legal function, to strengthen employee training regarding personal information protection. The Company has also instructed Recruit Career to reinforce its governance structure including the verification process of trial-based products, and has confirmed that Recruit Career has taken these initiatives.

In addition, the Company led Recruit to establish an Advisory Committee on Data Utilization which includes outside advisors and plans to organize the first committee meeting in December.

Consolidated Financial Results Guidance for FY2019

Q17:

Is there any change in consolidated financial results guidance for FY2019?

A17:

There is no revision of consolidated financial guidance for FY2019 from the figures announced on May 14, 2019. For the Staffing segment, the Company revised partially in Q1 FY2019 and there is no revision in Q2.

The partial revision for Staffing segment in Q1 FY2019 was as below:

The Company previously announced, on May 14 2019, segment revenue was expected to grow low single digits, comprised of an increase in both Japan and Overseas operations. However, the revenue in Overseas operations may decrease as the Company expects the uncertain outlook, mainly in Europe, to continue and will further improve productivity by implementing the Unit Management System. The Company continues to expect revenue of the overall Staffing segment and Japan operations to increase low single digits and adjusted EBITDA margin for the Staffing segment to improve slightly for FY2019.

6. Results Materials

Latest Investors' Kit(2.8 MB)(ZIP)

Financial Results Summary (269 KB)

Supplemental Financial Data(386 KB)(Excel)

2Q Presentation Material (433 KB)

Presentation transcript (126 KB)

In preparing these materials, Recruit Holdings Co., Ltd. relies upon and assumes the accuracy and completeness of all available information. However, we make no representations or warranties of any kind, express or implied, about the completeness and accuracy. This presentation also contains forward-looking statements. Actual results, performance and achievements are subject to various risks and uncertainties. Accordingly, actual results may differ significantly from those expressed or implied by forward-looking statements. Readers are cautioned against placing undue reliance on forward-looking statements. Reported results should not be considered as an indication of future performance. Forward-looking statements in this press release are based on information available to us on the date hereof. We undertake no duty to update this information unless required by law.