Newsroom

- IR

Recruit Holdings Announces Purchase of Shares based on the Stock Incentive Plan for the Directors of the Board and Selected Senior Management of the Company and its Subsidiaries

May 27, 2020

TOKYO, JAPAN (May 27, 2020) - Recruit Holdings Co., Ltd. (TSE 6098) (the "Company") announced, following a resolution by the Board of Directors meeting held today, its plan to purchase shares of the Company based on the conditions previously approved by the required decision-making bodies. The purchased shares shall be used for the purpose of the stock incentive plan (the "Scheme") for the Directors of the Board, and Corporate Executive Officers and Corporate Professional Officers ("Senior Management") of the Company and its subsidiaries (the "Subject Companies").

1. Purpose of the Scheme

The Subject Companies have implemented the Scheme in 2016, as a long-term incentive plan for Directors of the Board and Senior Management, by establishing a strong connection between their compensation and shareholder value. The Company believes this Scheme contributes to an increase in mid- to long-term business performance and enterprise value.

2. Details of the Scheme

(1)The Scheme is a stock incentive plan, which the Company implemented for its Directors of the Boards and Senior Management in 2016, and for Directors of the Board and Senior Management of its subsidiaries after that.

(*) In regard to the stock incentive plan for Directors of the Board and Senior Management of the Company, please refer to the "Notification of Introduction of the Performance-based Stock Incentive Plan for Board Directors" released on May 13, 2016 and "Recruit Holdings Co., Ltd. Announces a Partial Revision of the Stock Incentive Plan for its Board Directors, etc" released on May 15, 2018.

(2)The Scheme adopts the structure used for a Board Incentive Plan Trust (the "BIP Trust"). The BIP Trust is a stock incentive plan in which the Company's shares are acquired through a trust using the capital contribution by the Subject Companies as remuneration for Directors of the Board and Senior Management. They receive the payout in form of a grant or payment (the "Grant") of the Company's shares and the monetary equivalent value of such shares (the "Company's shares") at time of retirement in principle, to their rank and the level of attainment of performance targets.

(3)The Subject Companies of the Scheme for the current fiscal year are defined as the Company and its subsidiaries, and the implementation of the Scheme was approved at the appropriate decision-making body.

(4)The Subject Companies intend to continue operating in future years the Scheme by establishing new trusts annually, or by making amendments to the existing trusts after the expiry of the trust period and making additional contributions to such existing trusts.

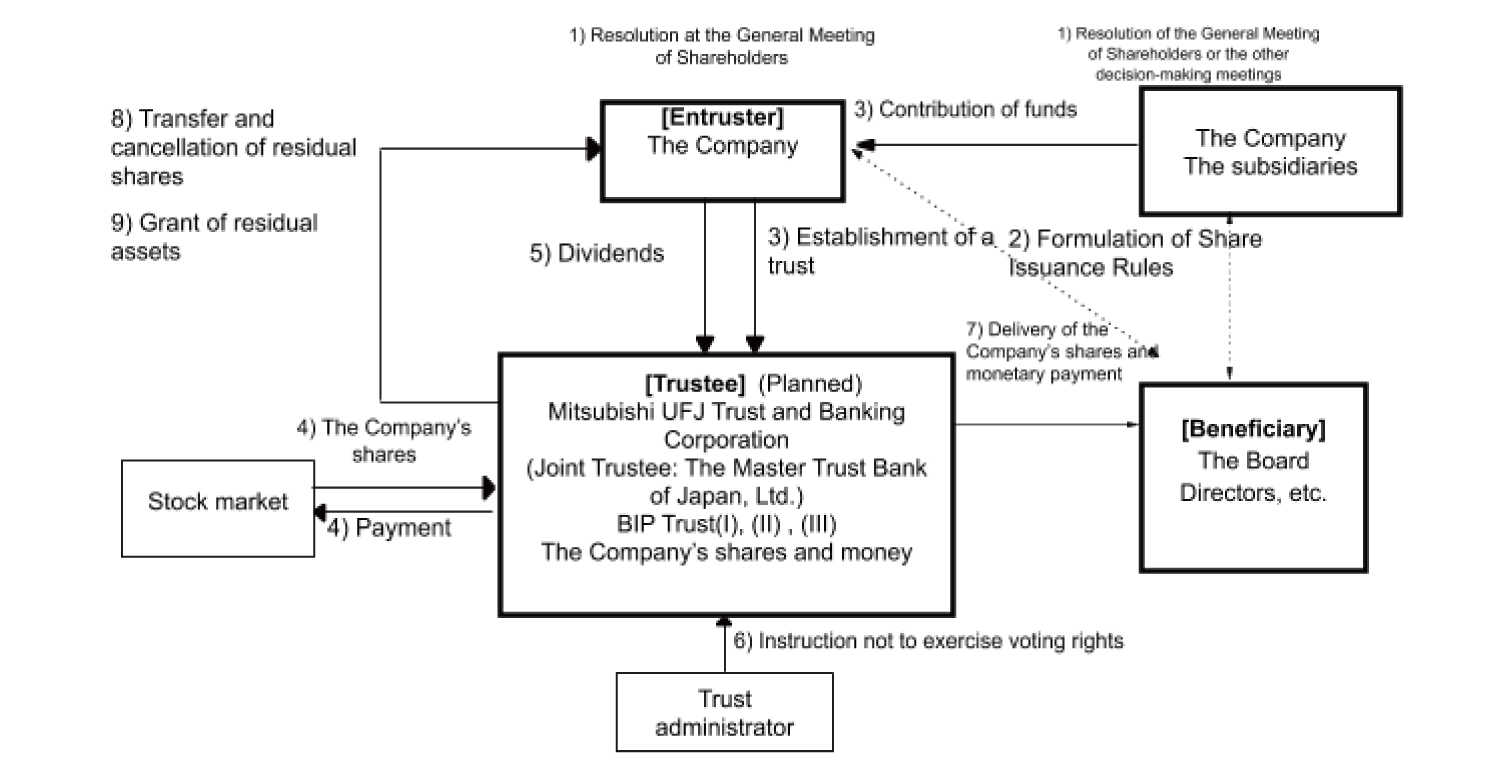

3. Framework of the Scheme

1) The Subject Companies obtained approval for the implementation of the Scheme for the Directors of the Board and Senior Management at the annual meeting of shareholders or the other decision-making meetings.

2) The Company revised the Share Issuance Rules at the Board of Directors meeting with respect to the continuous implementation of the Scheme. (The Subsidiaries establish the Share Issuance Rules at the Board of Directors meeting with respect to the implementation of the Scheme.)

3) The Company entrusts money which the Company contributed as stock compensation and the money contributed by the subsidiaries to the trustee, and establishes or extends the Trust BIP(I),Trust BIP(II) and Trust BIP(III) (hereinafter collectively referred to as the "Trusts"). The Trust BIP(I) is for the Directors of the Board and Senior Management of the Company who meet the beneficiary requirements as its beneficiary and the Trust BIP(II) and Trust BIP(III) is for the Directors of the Board and Senior Management of the subsidiaries who meet the beneficiary requirements as its beneficiary. The Subject Companies are allowed to contribute money within the limit as approved by the annual meeting of shareholders or the other decision-making meetings in 1).

4) The Trusts follow the instruction of the trust administrator and acquire the Company's shares from the stock market using the money contributed in 3).

5) The Company's shares held in the Trusts are entitled to receive dividends in the same manner as other Company's shares.

6) No voting rights shall be exercised on the Company's shares held in the Trusts during the trust period.

7) During the trust period, a certain number of points are granted to the Directors of the Board and Senior Management mainly according to their responsibility and the achievement of performance targets. The Grant of the Company's shares corresponding to the number of points are offered to the Directors of the Board and Senior Management who meet certain beneficiary requirements, in principle, at the time of their retirement or at the end of performance period. (The Directors of the Board and Senior Management are, in principle, granted 50% of the Company's shares corresponding to the points (fractional shares are omitted) in accordance with the provisions of the trust agreement, while the remaining Company's shares corresponding to the points are converted to money within the Trusts and paid to the Directors of the Board and Senior Management in money.)

8) If there are residual shares at the expiry of the trust period, the Subject Companies will either continuously use the Trusts for the Scheme, or as another incentive plan similar to the Scheme, by amending the trust agreement by the resolution of the Board of Directors and having additionally contribute to the Trusts, or will transfer the residual shares from the Trusts to the Company without compensation, acquire them without compensation, and cancel them by a resolution of the Board of Directors.

9) At the termination of the Trusts, residual assets remaining after the distribution to the beneficiaries will be attributable to the Subject Companies within the amount of the reserve for trust expenses after deducting share acquisition funds from the trust money. Any portion in excess of the reserve for trust expenses will be donated to organizations with no interest in the Subject Companies.

(Note)If the Company's shares are exhausted within the Trusts due to the Grant of the Company's shares to the Directors of the Board and Senior Management, who meet the beneficiary requirements, the Trusts shall be terminated prior to the expiry of the trust period. The Company may entrust money to the Trusts and the subsidiaries may additionally entrust money to the Trusts through the Company as acquisition funds for the Company's shares, thereby causing the Trusts to additionally acquire the Company's shares within the limit of the share acquisition funds as well as within the maximum number of shares to be granted as approved by the resolution of the annual meeting of shareholders.

4. Outline of the trust agreement

| BIP(I) (the Company) | BIP(II) (III) (the subsidiaries) | ||

|---|---|---|---|

| (1) | Type of trust | Monetary trust other than a specified solely-administered monetary trust (third-party benefit trust) | |

| (2) | Purpose of trust | Providing incentive to the following subject persons | |

| (3) | Subject persons | The Directors of the Board and Senior Management of the Company | The Directors of the Board and Senior Management of the subsidiaries |

| (4) | Entruster | The Company | |

| (5) | Trustee | Mitsubishi UFJ Trust and Banking Corporation (Planned) (Joint Trustee: The Master Trust Bank of Japan, Ltd.) |

|

| (6) | Beneficiary | The Directors of the Board and Senior Management who meet the beneficiary requirements | |

| (7) | Trust administrator | A third party with no interest in the Company | |

| (8) | Date of trust agreement | May 15, 2017 (Scheduled to change on May 28, 2020) |

May 28, 2020 (planned) |

| (9) | Trust term | May 15, 2017 to August 31, 2023 (planned) | May 28, 2020 to August 31, 2023 (planned) |

| (10) | Commencement date of the scheme | May 15, 2017 | May 28, 2020 |

| (11) | Exercise of voting rights | Voting rights will not be exercised. | |

| (12) | Class of shares to be acquired | Common stock of the Company | |

| (13) | Amount of trust | ¥1.2 billion (planned) | ¥0.8 billion (planned) |

| (each including trust fees and trust expenses) | |||

| (14) | Timing for acquiring shares | May 29, 2020 (planned) to June 19, 2020 (planned) | |

| (15) | Method of share acquisition | Acquisition from the stock market | |

| (16) | Rights holder | The Company | |

| (17) | Residual assets | The Company, as the rights holder, may receive residual assets within the scope of reserve for trust expenses after deducting share acquisition fund from trust money. | |

(Note)The scheduled dates mentioned above may be changed to appropriate dates in light of applicable laws and regulations.

[Details of administration relating to the trusts and shares]

| (1) | Trust-related administration | Mitsubishi UFJ Trust and Banking Corporation and The Master Trust Bank of Japan, Ltd. are to be the trustees of the Trusts and will conduct trust-related administration. |

|---|---|---|

| (2) | Share-related administration | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. will conduct administration related to the delivery of the Company's shares to beneficiaries based on the administration service agreement. |