Newsroom

- IR

Recruit Holdings Announces Issuance of Stock Options

July 8, 2020

TOKYO, JAPAN (July 8, 2020) - Recruit Holdings Co., Ltd. (TSE: 6098) (the "Company") announced, following a resolution by the Board of Directors meeting held today, that it will issue stock options to Directors of the Board (excluding Outside Directors; the same applies hereinafter) and Corporate Executive Officers in accordance with the conditions previously approved by the required decision-making bodies.

1. Purpose of Issuing Stock Options

The Company intends to issue stock options to Directors of the Board and Corporate Executive Officers as a remuneration which can be realized only when the stock price increases for the purpose of encouraging the commitment to stock price appreciation and corporate value expansion, as well as sharing the advantages and risks of stock price fluctuations with shareholders.

2. Terms and Conditions of Stock Options

(1) Name of stock options

Recruit Holdings Co., Ltd. Series 5 stock options

(2) Persons to whom the stock options to be allotted and number of those persons, and number of the stock options to be allotted

Company's Directors of the Board (excluding Outside Directors):

4 persons 2.061 stock options

Company's Corporate Executive Officers (shikko-yakuin):

5 persons 760 stock options

(3) Total number of stock options

2,821 stock options

However, above total number is the number of stock options scheduled to be allotted, and if the total number of the stock options to be allotted decreases because the total number of subscriptions for the stock options does not reach the total number described above or for other reasons, then the total number of the stock options to be issued shall be such total number of the stock options to be allotted.

(4) Class and number of shares to be acquired upon exercise of the stock options

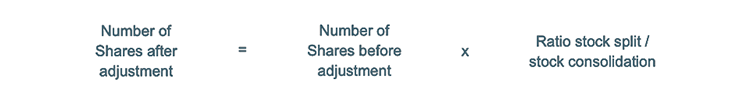

The class of shares to be acquired upon exercise of the stock options shall be common stock of the Company, and the number of shares to be acquired upon exercise of one stock acquisition right (the "Number of Shares") shall be 100 shares; provided, however, that if the Company carries out a stock split (including gratis allotment of common stock of the Company; the same applies hereinafter where reference to stock split is made) or stock consolidation after the allotment date of the stock options (the "Allotment Date"), the Number of Shares will be adjusted in accordance with the following formula, and any fraction less than one share resulting from the adjustment shall be rounded down to the nearest whole share.

If after the Allotment Date, the Company carries out a merger or company split, or any unavoidable circumstances that require an adjustment of the Number of Shares otherwise occur, the Company may adjust the Number of Shares to a reasonable extent.

(5) Amount to be paid in for the stock options

No cash payment is required for the stock options. The stock options are allotted as consideration for the performance of duties, and the issue thereof does not constitute an issuance under advantageous conditions.

(6) Allotment Date of the stock options

July 27, 2020

(7) Amount of assets to be contributed upon exercise of the stock options

The amount of assets to be contributed upon exercise of the stock options shall be the amount calculated by multiplying the amount per share of the assets to be contributed upon exercise of the stock options (the "Exercise Price") by the Number of Shares.

The Exercise Price shall be the closing price of the Company's shares of common stock in regular trading on the Tokyo Stock Exchange on the Allotment Date (or, if there are no transactions in relation to the Company's shares on such date, the closing price on the trading day immediately before the Allotment Date).

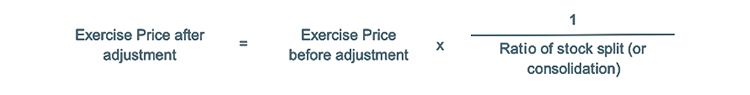

If the Company carries out a stock split or stock consolidation after the Allotment Date, the Exercise Price will be adjusted in accordance with the following formula, and any fraction less than one yen resulting from the adjustment shall be rounded up to the nearest whole yen.

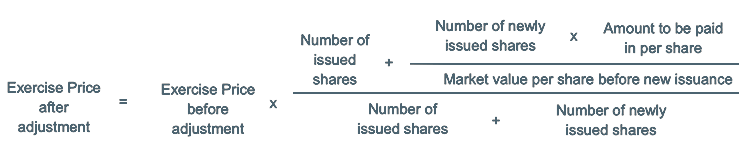

If after the Allotment Date, the Company issues new shares or disposes of treasury shares of the Company's common stock at a price less than the market value (excluding issuance of new shares and disposal of treasury shares upon exercise of stock options, and transfer of treasury shares by means of share exchange), the Exercise Price will be adjusted in accordance with the following formula, and any fraction less than one yen resulting from the adjustment shall be rounded up to the nearest whole yen.

In the formula above, the "Number of issued shares" is the total amount of issued shares of common stock of the Company less the number of treasury shares of common stock of the Company immediately prior to the issuance or disposition, and if the treasury shares of common stock of the Company are disposed of, the "Number of newly issued shares" will be read as the "Number of treasury shares disposed of."

In addition to the above, if after the Allotment Date, the Company carries out a merger or company split, or an event that requires an adjustment of the Exercise Price otherwise occurs, the Company may appropriately adjust the Exercise Price to a reasonable extent.

(8) Exercise period of stock options

The exercise period shall be from July 27, 2020 to July 26, 2030, but if the last day of the exercise period is a holiday of the Company, the last day of the exercise period will be the immediately preceding business day.

(9) Conditions of exercise of the stock options

Stock options cannot be exercised in fractional portions.

If a holder of the stock options (the "stock options Holder") loses all of his or her status as a Board Director and/or Corporate Executive Officer of the Company during the period in which it may exercise the stock options, such stock options Holder may exercise the stock options only for the period up to the earlier of the day that is three years from the date of such loss of status or the last day of the exercise period of the stock options set out in Paragraph (8) above.

A stock options Holder is not allowed to pledge or otherwise dispose of the stock options.

Other conditions will be set out in the stock options allotment agreement to be executed between the Company and the stock options Holder pursuant to the resolution of the Company's Board of Directors.

(10) Amount of stated capital and capital reserve to be increased upon the issuance of shares upon exercise of the stock options

The amount of stated capital to be increased upon the issuance of shares upon exercise of the stock options will be one-half of the maximum amount of increase of stated capital calculated in accordance with Article 17, Paragraph 1 of the Regulation on Corporate Accounting, and any amount less than one yen resulting from the calculation will be rounded up to the nearest yen.

The amount of capital reserve to be increased upon the issuance of shares upon exercise of the stock options will be the amount obtained by subtracting the amount of stated capital to be increased as set out in Item (1) above from the maximum amount of increase of stated capital set out in Item (1) above.

(11) Matters relating to acquisition of the stock options

If a stock options Holder becomes unable to exercise the stock options in accordance with the provisions of Paragraph (9) above or the provisions of the share options allotment agreement before the exercise of the rights, the Company may acquire the relevant stock options at no cost on the day separately designated by the Board of Directors.

(12) Restrictions on assignment of stock options

Assignment of the stock options requires approval of the Company's Board of Directors.

(13) Handling of stock options upon reorganization

If the Company conducts a merger (only if the Company is to be dissolved as a result of the merger), absorption-type corporate split (only in the event that the Company should split-up), incorporation-type company split, share exchange (only if the Company becomes a wholly-owned subsidiary), or share transfer (collectively, a "Reorganization"), the Company will deliver stock options of a stock company set out in (a) through (e) of Article 236(1)(viii) of the Companies Act (collectively, the "Reorganized Company") to a stock options Holder holding the stock options that are outstanding at the time that the Reorganization becomes effective (the "Outstanding stock options") on the following conditions. In this case, the Outstanding stock options will be terminated. The foregoing shall only apply if the delivery of stock options by the Reorganized Company on the following conditions is provided in the absorption-type merger agreement, incorporation-type merger agreement, absorption-type corporate split agreement, incorporation-type company split plan, share exchange agreement, or share transfer plan.

Number of stock options of the Reorganized Company for delivery

The holders of the Outstanding stock options will receive the same number of stock options of the Reorganized Company.

Class of shares of the Reorganized Company to be acquired upon exercise of the stock options

Common stock of the Reorganized Company

Number of shares of the Reorganized Company to be acquired upon exercise of the stock options

This will be determined in accordance with Paragraph (4) above after considering the terms and conditions of the Reorganization.

Amount of assets to be contributed upon exercise of the stock options

The amount of assets to be contributed upon exercise of the stock options to be delivered shall be the amount calculated by multiplying (x) the Exercise Price after the Reorganization obtained as a result of the adjustment of the Exercise Price set out in Paragraph (7) above by (y) the number of shares of the Reorganized Company to be acquired upon exercise of the stock options to be determined pursuant to Item (iii) above, after considering the terms and conditions of the Reorganization.

Exercise Period of stock options

The exercise period of the stock options will be from the later of the commencement date of the period set out in Paragraph (8) above in which the stock options are exercisable or the effective date of the Reorganization, through the last date of the period set out in Paragraph (8) above in which the stock options are exercisable.

Matters regarding stated capital and capital reserve to be increased by the issuance of new shares upon exercise of the stock options

This will be determined in accordance with Paragraph (10) above.

Restrictions on acquiring the stock options by means of a transfer

Acquiring stock options by means of a transfer requires approval of the Reorganized Company.

Conditions of exercise of stock options

This will be determined in accordance with Paragraph (9) above.

Matters relating to acquisition of the stock options

This will be determined in accordance with Paragraph (11) above.

With respect to the number of shares to be delivered to the stock options Holders who exercise their stock options, any fraction of a share will be rounded down to the nearest whole share.

(14) Arrangement for fractions less than one share arising through exercise of stock options

With respect to the number of shares to be delivered to the stock options Holders who exercise their stock options, any fraction of a share will be rounded down to the nearest whole share.

(15) Matters related to the of stock acquisition right certificates

The Company will not issue stock acquisition right certificates for the stock options.

Recruit Holdings Announces Issuance of Stock Options (150 KB)