Newsroom

- IR

Q1 FY2020 Financial Results

Aug 26, 2020

TOKYO, JAPAN (Aug. 26, 2020) - Recruit Holdings Co., Ltd. ("Recruit Holdings" or the "Company") today announced its financial results for the three months ended June 30, 2020 (unaudited).

1. 3 Months FY2020 Consolidated Financial Highlights

Consolidated revenue of 475.4 billion yen (-20.0%), adjusted EBITDA of 53.4 billion yen (-38.8%), adjusted EPS of 17.49 yen (-47.5%).

Operating income significantly decreased due to decreased revenue and 9.8 billion yen of other operating expenses. Other operating expenses include additional non-recurring expenses arising from COVID-19 related measures and a loss on the sale of a subsidiary.

Reduced SG&A expenses by 44.0 billion yen yoy which was driven mainly by reduced advertising expenses and promotion expenses, as well as lower sales commissions which were directly correlated to revenue.

(In billions of yen, unless otherwise stated)

| FY2019 | FY2020 | ||

|---|---|---|---|

| Q1 | Q1 | YoY | |

| Revenue | 594.4 | 475.4 | △20.0% |

| Adjusted EBITDA | 87.3 | 53.4 | △38.8% |

| Adjusted EBITDA margin | 14.7% | 11.2% | - |

| Operating income | 71.2 | 26.6 | △62.6% |

| Profit attributable to owners of the parent | 59.3 | 22.3 | △62.4% |

| Adjusted EPS (yen) | 33.29yen | 17.49yen | △47.5% |

2. Q1 FY2020 Segment Highlights

HR Technology:

Revenue decreased by 27.5% yoy and by 25.8%*¹ yoy in US dollar terms. Revenue decline was primarily driven by a decrease in sponsored job advertising and reduced demand for recruiting solutions.

Adjusted EBITDA decreased by 59.4% yoy, primarily driven by the decline in revenue. Adjusted EBITDA margin was 10.6% (18.9% in Q1 FY2019).

Continued reduction of investments in sales and marketing and hiring pause since March.

*1 The US dollar based revenue reporting represents the financial results of operating companies in this segment on a US dollar basis, which differ from the consolidated financial results of the Company.

Media & Solutions:

Revenue decreased by 29.1% yoy. Revenue in both Marketing Solutions and HR Solutions decreased.

Adjusted EBITDA decreased by 45.4% yoy, primarily due to decreased revenue in both operations. Adjusted EBITDA margin was 20.6% (26.7% in Q1 FY2019).

Implemented quick and flexible cost controls, mainly by reducing marketing expenses while focusing on capturing enterprise clients' present and future demand for resuming their advertising and hiring activities.

Staffing:

Revenue decreased by 12.3% (-10.3% ex FX impact) yoy. Revenue for Japan operations increased by 5.9% and for Overseas operations decreased by 26.6% (-23.0% ex FX impact) yoy.

Adjusted EBITDA increased by 0.2% (Japan +44.7%, Overseas -64.8%) yoy. Adjusted EBITDA margin was 7.2%.

For Japan operations, both revenue and adjusted EBITDA increased yoy, primarily due to an additional two business days in the quarter compared to the previous year, and increased billing prices following the implementation of the equal pay for equal work regulations beginning April 1, 2020. Adjusted EBITDA margin was 11.7% (8.5% in Q1 FY2019).

For Overseas operations, both revenue and adjusted EBITDA decreased yoy, primarily due to restrictions on enterprise clients' business operations and the negative impact of FX movements. These conditions, as well as uncertainty about the future, led to a significant decline in demand from enterprise clients for temporary staff. Adjusted EBITDA margin was 2.2% (4.6% in Q1 FY2019). Overseas operations maintained a positive adjusted EBITDA margin by strengthening ongoing cost control initiatives.

Revenue

(In billions of yen)

| FY2019 | FY2020 | ||

|---|---|---|---|

| Q1 | Q1 | YoY | |

| Consolidated Revenue*² | 594.4 | 475.4 | △20.0% |

| HR Technology | 102.1 | 74.1 | △27.5% |

| (In million US dollars) Revenue in US dollars*¹ |

928 | 689 | △25.8% |

| Media & Solutions | 187.6 | 132.9 | △29.1% |

| Marketing Solutions | 105.7 | 77.1 | △27.1% |

| Housing and Real Estate | 26.7 | 24.9 | △6.6% |

| Beauty | 19.3 | 17.4 | △9.7% |

| Bridal | 13.2 | 7.1 | △46.0% |

| Travel | 17.5 | 6.0 | △65.3% |

| Dining | 9.5 | 1.7 | △81.3% |

| Others | 19.1 | 19.5 | +2.1% |

| HR Solutions | 81.1 | 55.1 | △32.1% |

| Recruiting in Japan | 71.9 | 49.1 | △31.7% |

| Others | 9.1 | 5.9 | △34.9% |

| Eliminations and Adjustments | 0.7 | 0.7 | △6.0% |

| Staffing | 312.5 | 274.2 | △12.3% |

| Japan | 137.7 | 145.8 | +5.9% |

| Overseas | 174.8 | 128.4 | △26.6% |

| Eliminations and Adjustments | (8.0) | (5.8) | - |

Adjusted EBITDA

(In billions of yen)

| FY2019 | FY2020 | ||

|---|---|---|---|

| Q1 | Q1 | YoY | |

| Consolidated Adjusted EBITDA*² | 87.3 | 53.4 | △38.8% |

| HR Technology | 19.3 | 7.8 | △59.4% |

| Media & Solutions | 50.1 | 27.3 | △45.4% |

| Marketing Solutions | 30.8 | 17.2 | △44.1% |

| HR Solutions | 23.5 | 14.9 | △36.6% |

| Eliminations and Adjustments | (4.2) | (4.7) | - |

| Staffing | 19.8 | 19.8 | +0.2% |

| Japan | 11.7 | 17.0 | +44.7% |

| Overseas | 8.0 | 2.8 | △64.8% |

| Eliminations and Adjustments | (1.9) | (1.6) | - |

Adjusted EBITDA Margin |

|||

| Consolidated Adjusted EBITDA Margin | 14.7% | 11.2% | - |

| HR Technology | 18.9% | 10.6% | - |

| Media & Solutions | 26.7% | 20.6% | - |

| Marketing Solutions | 29.1% | 22.3% | - |

| HR Solutions | 29.0% | 27.1% | - |

| Staffing | 6.3% | 7.2% | - |

| Japan | 8.5% | 11.7% | - |

| Overseas | 4.6% | 2.2% | - |

*1 The US dollar based revenue reporting represents the financial results of operating companies in this segment on a US dollar basis, which differ from the consolidated financial results of the Company.

*2 The total sum of the three segments does not correspond with consolidated numbers due to Eliminations and Adjustments, such as intra-group transactions.

3.Consolidated Financial Guidance for FY2020

Due to the uncertainty and rapidly evolving conditions around the world, the Company is unable at this time to reliably predict the impact that the global spread of COVID-19 will have on its FY2020 financial performance. As a result, the Company is not providing consolidated financial guidance for FY2020. The Company plans to provide consolidated financial guidance for FY2020 when the Company is able to reasonably estimate the magnitude of the impact of the global spread of COVID-19 on its business.

4. Latest Business Operation Update

The Company's consolidated monthly revenue for July exceeded that of June. However, monthly revenue decreased approximately 15% year on year, which was slightly worse than that of June.

Monthly revenue for July in HR Technology decreased approximately 7% yoy on a US dollar basis, in Media & Solutions decreased approximately 26% yoy, and in Staffing decreased approximately 10% yoy.

The global economic outlook remains uncertain, and lockdowns and other restrictions may continue or may be implemented again in many countries. Therefore, the Company expects that the global spread of COVID-19 will continue to have a significant adverse impact on financial performance in Q2 FY2020 and beyond.

Note:

Consolidated monthly revenue reporting represents the unaudited financial results of operating companies as reported on a monthly basis (before applying intercompany eliminations or adjustments) and monthly revenue reporting for segments represents the unaudited financial results of operating companies as reported on a monthly basis (excluding the impact of foreign exchange rate movements and before applying intercompany eliminations or adjustments). These figures may differ in certain material respects from the consolidated financial results of the Company reported under IFRS. Accordingly, monthly revenue figures are not comparable to consolidated revenue reported by the Company and should not be regarded as a substitute for the consolidated financial results of the Company.

5.FAQ's

Consolidated Financial Guidance for FY2020

Q1:

Consolidated financial guidance and dividend forecasts for FY2020 are not provided. Is the outlook still uncertain?

A1:

Revenue and adjusted EBITDA for Q1 FY2020 were adversely impacted by the spread of COVID-19 and decreased 20.0% and 38.8% year on year, respectively. Consolidated monthly revenue for July*¹ exceeded that of June. However, monthly revenue decreased approximately 15% year on year, which was slightly worse than that of June. The global economic outlook remains uncertain, and lockdowns and other restrictions may continue or may be implemented again in many countries. The Company plans to provide consolidated financial guidance and dividend forecast for FY2020 when the Company is able to reasonably estimate the magnitude of the impact of the global spread of COVID-19 on its business.

*1 Consolidated monthly revenue reporting represents the unaudited financial results of operating companies as reported on a monthly basis (before applying intercompany eliminations or adjustments), which may differ in certain material respects from the consolidated financial results of the Company reported under IFRS. Accordingly, monthly revenue figures are not comparable to consolidated revenue reported by the Company and should not be regarded as a substitute for the consolidated financial results of the Company.

Consolidated Results

Q2:

The business environment has been very challenging. How did the Company control operating expenses, such as advertising?

A2:

Selling, general and administrative expenses decreased 44.0 billion yen, a decrease of 17.8% year on year in Q1 FY2020. The decrease in these expenses was driven mainly by reducing advertising expenses by 18.8 billion yen compared to Q1 FY2019, to 16.1 billion yen, as a result of quick operational decisions in HR Technology and Media & Solutions. Promotion expenses were reduced and sales commissions, which are directly correlated to revenue, decreased year on year. The Company will continue to manage its expenses, but will also proactively invest wisely to execute its mid- to long-term growth strategy.

Q3:

Why did operating income decrease 62.6% year on year, while revenue decreased 20.0% year on year?

A3:

In addition to the decreased operating income from HR Technology and Media & Solutions segments, the Company recorded other operating expenses of 9.8 billion yen, an increase of 8.1 billion yen compared to Q1 FY2019. Operating expenses in Q1 FY2020 included 3.5 billion yen of additional non-recurring expenses arising from COVID-19 related measures and a 3.1 billion yen accounting loss on the sale of Hot Ventures Limited, which operates Treatwell, a European beauty business. In Q4 FY2019, the Company took an impairment loss to operate Treatwell under a new business plan. However, during Q1 FY2020, the Company decided to dispose of the asset when it was approached and proposed by a suitable long-term strategic partner for Treatwell.

HR Technology

Q4:

As mentioned in the earnings release, job seeker traffic declined significantly due to the spread of COVID-19. Isn't it natural that job seeker traffic increases with high unemployment?

A4:

While job seekers that are newly unemployed may in fact increase their online job seeking activity, there are several factors that most likely led to an initial decrease in overall traffic in response to COVID-19.

Firstly, many job seekers were reluctant to search for new jobs and go to work due to health-related concerns. Secondly, Indeed and Glassdoor are also resources for job seekers that are currently employed, but interested in finding a new job and company, and in this time of economic uncertainty those job seekers were cautious about changing jobs. Lastly, job seekers who have lost their job may receive unemployment benefits that could discourage them from seeking new work in the short term.

However, in July, as restrictions were lifted and businesses resumed hiring activities, Indeed's monthly unique visitor traffic has recovered to pre-COVID-19 levels. However, HR Technology is treating these recent positive trends very cautiously as they could reverse if health or economic conditions worsen.

Q5:

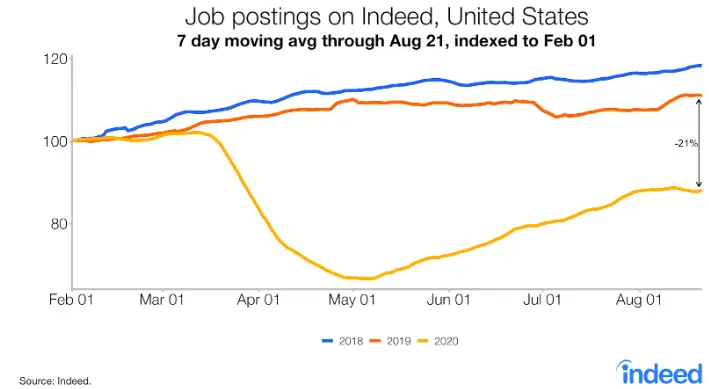

How did COVID-19 impact the number of job postings on Indeed.com?

A5:

Indeed provides information related to the labor market in countries where Indeed has a relevant share of open jobs through its website Indeed Hiring Lab (https://www.hiringlab.org/). The data analyzed by the Indeed Hiring Lab includes paid and unpaid job posts and is not directly correlated to revenue. Per the August 25, 2020 blog, the number of job postings on Indeed.com in the United States began decreasing in the latter half of March, reaching the low point on May 1, as of August 26, 2020. The growth rate from February 1 to May 1 of the 7-day moving average number of jobs decreased 39.3% in 2020 compared to the growth in jobs during the same period in 2019. The trend in job postings has slowly begun to recover, with the 7-day moving average job posting volume growth at August 21 compared to February 1 down 20.8% in 2020 compared to the growth rate during the same period in 2019.

Q6:

Some competitors implemented drastic layoffs as a cost management measure. Did Indeed or Glassdoor take similar measures?

A6:

Indeed did not implement layoffs and does not currently have layoffs planned. Indeed believes in its mid- to long-term strategy and is ensuring it is in the best position to support job seekers and enterprise clients as the economy recovers and hiring rebounds.

To control costs in Q1 FY2020, Indeed continued its reduction of investments in sales and marketing and its hiring pause.

Glassdoor, on the other hand, reduced its workforce in Q1 FY2020 as part of a strategic decision to accelerate collaboration with Indeed.

Media & Solutions

Q7:

The spread of COVID-19 had a significant impact on the performance of Marketing Solutions in Q1 FY2020. Did the Company see any signs of recovery in revenue of Marketing Solutions after the state of emergency was lifted in Japan?

A7:

Following the lifting of the state of emergency in Japan, individuals' consumption activity resumed, particularly in Beauty. This led to an increase in the number of Beauty enterprise clients' advertising in June compared to the lowest point earlier in Q1 FY2020. In Housing and Real Estate, the decrease in the number of advertising placements was minor compared to other subsegments. The counter service, which provides consultation for housing and real estate, was closed during the state of emergency, but individual users' visits are recovering following the state of emergency being lifted in Japan.

The demand for Bridal, Travel, and Dining, which were severely impacted by the spread of COVID-19, also resumed in June, partially stimulated by the Go To campaign subsidized by the Japanese government, although it has not yet recovered to pre-COVID-19 levels. As individuals avoid gathering in large groups and traveling, and restaurants limit open hours and reduce the number of tables, enterprise clients are unable to operate their businesses as before. Therefore, the Company anticipates it will take some time before the advertising volume of enterprise clients recovers to pre-COVID-19 levels.

Q8:

How was HR Solutions able to maintain adjusted EBITDA margin of 27.1% while revenue declined 32.1% year on year? What is the Company's outlook regarding the performance of HR Solutions?

A8:

HR Solutions maintained adjusted EBITDA margin of 27.1% in Q1 FY2020. In addition to a decrease in sales commissions due to a decline in revenue, HR Solutions effectively reduced operating costs.

Additionally, adjusted EBITDA margin was positively impacted by the difference in the timing of recognition of revenue and of sales commissions paid to agencies. While revenue in the job board business is recognized over the period of advertisement, the related sales commissions are recognized when the advertisement is contracted if the period of advertisement does not exceed one year. Revenue in the job board business for Q1 includes revenue generated by advertisements which were contracted before Q1, while sales commissions in Q1 decreased significantly as new advertising agreements declined due to the spread of COVID-19.

While it is still uncertain, the Company expects revenue in HR Solutions will gradually recover as the business environment for enterprise clients improves. However, as the placement business operates on a pay-per-hire model in which revenue is recognized when a candidate is hired by an enterprise client, revenue from the placement business in Q2 and beyond will be impacted by the decreased new hiring activities in Q1.

The economic outlook remains uncertain and there is a possibility of a second wave of COVID-19 that may lead to another downturn in our business.

Q9:

Why did Recruit Co., Ltd. receive a consignment agreement of administrative work for the rent assistance program by The Small and Medium Enterprise Agency in Japan? Is there any impact financially for FY2020?

A9:

The Company participated in the bidding, and received an agreement in order to help SMEs and individual business owners, whose businesses have been severely impacted by the spread of COVID-19, by supporting the Agency to facilitate the rent assistance program efficiently.

The Company offers day-to-day management and operation support services, including SaaS solutions centered on Air BusinessTools, and aims to solve various challenges SMEs face every day in their business operations.

The financial impact related to the rent assistance program was insignificant in Q1 FY2020. The Company will receive and distribute the government rent subsidy to applicants of the program and the consignment fee for the rent assistance program will be allocated to each of the six companies in the consortium. The Company is in discussions with its auditor regarding the accounting treatment of these transactions for Q2 FY2020 and beyond.

Staffing

Q10:

Is it going to be more difficult to maintain adjusted EBITDA margins in the future if the demand from enterprise clients declines?

A10:

The Company's staffing business is primarily a contingent staffing service, in which the employment contract is terminated when the temporary employment assignment ends. In terms of the business model, revenues are generated from fees the Company receives from enterprise clients for its staffing services, and salaries and other payments to temporary staff are recorded in cost of sales. When revenue declines due to less demand for temporary staff from enterprise clients, the cost of sales also declines.

Based on this business model, and by continuously implementing the Unit Management System, the Company believes that it will be able to maintain adjusted EBITDA margins at a certain positive level with some fluctuation in the midst of the current challenging business environment.

Q11:

How did the "equal pay for equal work" guidelines affect the performance of Japan operations in Q1 FY2020?

A11:

Prior to the implementation of the "equal pay for equal work" guidelines, benefits and compensation schemes for temporary staff were reviewed, and upward adjustments were made to their contracts, where necessary. As a result, the Company raised billing prices and payments to temporary staff accordingly, with the majority of enterprise clients agreeing to this price adjustment. In addition to the two extra business days in Q1 FY2020, the upward price adjustment was a primary reason for the year on year increase in revenue and adjusted EBITDA in Japan operations in Q1 FY2020.

Going forward, "equal pay for equal work" will have a lasting positive impact on billing prices. However, the overall Japan operations revenue and adjusted EBITDA outlook for Q2 FY2020 and beyond is uncertain as the continued implementation of "equal pay for equal work" related systems may increase administrative costs and the outlook for enterprise clients' demand for temporary staffing services is uncertain due to the prolonged COVID-19 impact on enterprise clients' businesses.

6. Audio

7. Results Materials

Latest Investor's Kit(843 KB)(ZIP)

Financial Results Summary (207 KB)

Supplemental Financial Data(123 KB)(Excel)

Conference Call Transcript For Q1 FY2020 (118 KB)

Forward-Looking Statements

This document contains forward-looking statements, which reflect the Company's assumptions and outlook for the future and estimates based on information available to the Company and the Company's plans and expectations as of the date of this document or other date indicated. There can be no assurance that the relevant forecasts and other forward-looking statements will be achieved. Please note that significant differences between the forecasts and other forward-looking statements and actual results may arise due to various factors, including changes in economic conditions, changes in individual users' preferences and enterprise clients' needs, competition, changes in the legal and regulatory environment, fluctuations in foreign exchange rates, and other factors. Accordingly, readers are cautioned against placing undue reliance on any such forward-looking statements. The Company has no obligation to update or revise any information contained in this document based on any subsequent developments except as required by applicable law or stock exchange rules and regulations.

Third-Party Information

This document includes information derived from or based on third-party sources, including information about the markets in which the Company operates. These statements are based on statistics and other information from third-party sources as cited herein, and the Company has not independently verified and cannot assure the accuracy or completeness of any information derived from or based on third-party sources.