Newsroom

- IR

Q2 FY2020 Financial Results

Nov 16, 2020

TOKYO, JAPAN (Nov. 16, 2020) - Recruit Holdings Co., Ltd. ("Recruit Holdings" or the "Company") today announced its financial results for the six months ended September 30, 2020 (unaudited).

1. 6 Months FY2020 Consolidated Financial Highlights

Consolidated revenue*¹ of 1,044.6 billion yen (-13.0%), revenue excluding the Rent Assistance Program was 1,015.1 billion yen (-15.5%), adjusted EBITDA of 123.4 billion yen (-30.6%), adjusted EPS of 41.83 yen (-38.4%).

The global spread of COVID-19 had a broad impact on business performance, resulting in year on year revenue decreases, however, revenue growth rates improved quarter on quarter in all three segments.

Reduced SG&A expenses by 65.8 billion yen yoy driven mainly by reduced advertising expenses and promotion expenses, as well as lower sales commissions which were directly correlated to revenue.

(In billions of yen, unless otherwise stated)

| FY2020 | ||||

|---|---|---|---|---|

| Q2 | YoY | 6M | YoY | |

| Revenue*¹ | 569.1 | △6.2% | 1,044.6 | △13.0% |

| Revenue (ex Rent Assistance Program) | 539.6 | △11.1% | 1,015.1 | △15.5% |

| Adjusted EBITDA | 69.9 | △22.6% | 123.4 | △30.6% |

| Adjusted EBITDA margin | 12.3% | △2.6 pt | 11.8% | △3.0 pt |

| Operating income | 48.0 | △32.7% | 74.7 | △47.6% |

| Profit attributable to owners of the parent | 40.2 | △26.7% | 62.5 | △45.2% |

| Adjusted EPS | 24.35 yen | △29.8% | 41.83 yen | △38.4% |

*1 Revenue for the six months ended September 30, 2020 includes 29.5 billion yen from the Rent Assistance Program by The Small and Medium Enterprise Agency of the Ministry of Economy in Japan.

2. Q2 FY2020 Segment Highlights

HR Technology:

Revenue decreased by 3.1% yoy and by 2.3%*¹ yoy in US dollar terms. Revenue decline was primarily driven by decreased demand year on year for sponsored job advertising, candidate sourcing and screening solutions, and employer branding products.

Adjusted EBITDA decreased by 39.5% yoy, primarily driven by the decline in revenue and increased investments in product and technology initiatives to develop solutions that serve the changing needs of enterprise clients and individual users. Adjusted EBITDA margin was 14.3% (22.9% in Q2 FY2019).

Increased marketing investments compared to Q1 FY2020 and resumed limited hiring in the latter half of the second quarter, in reaction to Q2 revenue trend.

*1 The US dollar based revenue reporting represents the financial results of operating companies in this segment on a US dollar basis, which differ from the consolidated financial results of the Company.

Media & Solutions:

Revenue decreased by 9.3% (-24.8% ex revenue from the Rent Assistance Program) yoy. Excluding revenue from the Rent Assistance Program, revenue in each of Marketing Solutions and HR Solutions both decreased. Although revenue continued to slowly recover since June through the second quarter following the lifting of the state of emergency at the end of May, it remains below prior year levels.

Adjusted EBITDA decreased by 28.4% yoy, mainly due to the decline in HR Solutions. Adjusted EBITDA margin was 19.8% (25.2% in Q2 FY2019).

Staffing:

Revenue decreased by 6.0% (-7.0% ex FX impact) yoy. Revenue for Japan operations decreased by 0.7% and for Overseas operations by 10.2% (-11.9% ex FX impact) yoy.

Adjusted EBITDA increased by 6.3% (Japan +20.7%, Overseas -10.6%) yoy. Adjusted EBITDA margin was 7.5%.

For Japan operations, revenue decreased primarily due to one less business day in the quarter compared to the previous year, and lower demand for temporary staff amid the economic uncertainty, while adjusted EBITDA increased mainly due to ongoing cost control measures.

For Overseas operations, both revenue and adjusted EBITDA decreased yoy, primarily due to a decline in demand from enterprise clients for temporary staff under the continued restrictions on their business operations as well as uncertainty about the future. Overseas operations maintained a positive adjusted EBITDA margin by strengthening ongoing cost control initiatives.

Revenue

(In billions of yen)

| Q2 | 6M | |||||

|---|---|---|---|---|---|---|

| FY2019 | FY2020 | YoY | FY2019 | FY2020 | YoY | |

| Consolidated Revenue*² | 606.7 | 569.1 | △6.2% | 1,201.2 | 1,044.6 | △13.0% |

| HR Technology | 106.8 | 103.4 | △3.1% | 209.0 | 177.5 | △15.0% |

| Revenue in US dollars*¹ (In millions of US dollars) |

$996 | $973 | △2.3% | $1,925 | $1,662 | △13.7% |

| Media & Solutions | 190.5 | 172.8 | △9.3% | 378.2 | 305.8 | △19.1% |

| Marketing Solutions | 110.6 | 123.7 | 11.9% | 216.3 | 200.8 | △7.2% |

| Housing & Real Estate | 27.5 | 29.2 | 6.1% | 54.3 | 54.2 | △0.1% |

| Beauty | 20.2 | 20.6 | 1.7% | 39.6 | 38.1 | △3.9% |

| Bridal | 13.1 | 7.2 | △45.2% | 26.4 | 14.3 | △45.6% |

| Travel | 21.3 | 15.7 | △26.3% | 38.8 | 21.8 | △43.9% |

| Dining | 9.3 | 3.1 | △66.6% | 18.8 | 4.9 | △74.0% |

| Others | 18.9 | 47.8 | 152.4% | 38.1 | 67.3 | 76.7% |

| HR Solutions | 79.2 | 48.5 | △38.7% | 160.3 | 103.6 | △35.3% |

| Recruiting in Japan | 70.0 | 41.9 | △40.1% | 141.9 | 91.0 | △35.8% |

| Others | 9.2 | 6.6 | △28.1% | 18.4 | 12.6 | △31.5% |

| Eliminations and Adjustments | 0.6 | 0.5 | △21.4% | 1.4 | 1.2 | △13.0% |

| Staffing | 317.5 | 298.5 | △6.0% | 630.1 | 572.7 | △9.1% |

| Japan | 139.8 | 138.8 | △0.7% | 277.5 | 284.6 | 2.6% |

| Overseas | 177.7 | 159.6 | △10.2% | 352.5 | 288.0 | △18.3% |

| Eliminations and Adjustments | (8.0) | (5.7) | - | (16.1) | (11.5) | - |

Adjusted EBITDA

(In billions of yen)

| Q2 | 6M | |||||

|---|---|---|---|---|---|---|

| FY2019 | FY2020 | YoY | FY2019 | FY2020 | YoY | |

| Consolidated Adjusted EBITDA*² | 90.3 | 69.9 | △22.6% | 177.7 | 123.4 | △30.6% |

| HR Technology | 24.4 | 14.7 | △39.5% | 43.7 | 22.6 | △48.3% |

| Media & Solutions | 47.9 | 34.3 | △28.4% | 98.0 | 61.6 | △37.1% |

| Marketing Solutions | 31.3 | 30.7 | △1.7% | 62.1 | 48.0 | △22.7% |

| HR Solutions | 21.3 | 8.8 | △58.5% | 44.9 | 23.8 | △47.0% |

| Eliminations and Adjustments | (4.7) | (5.3) | - | (8.9) | (10.1) | - |

| Staffing | 21.1 | 22.4 | 6.3% | 40.9 | 42.3 | 3.4% |

| Japan | 11.4 | 13.8 | 20.7% | 23.2 | 30.8 | 32.8% |

| Overseas | 9.6 | 8.6 | △10.6% | 17.7 | 11.5 | △35.2% |

| Eliminations and Adjustments | (3.0) | (1.5) | - | (5.0) | (3.2) | - |

Adjusted EBITDA Margin |

||||||

| Consolidated Adjusted EBITDA Margin | 14.9% | 12.3% | △2.6pt | 14.8% | 11.8% | △3.0pt |

| HR Technology | 22.9% | 14.3% | △8.6pt | 20.9% | 12.7% | △8.2pt |

| Media & Solutions | 25.2% | 19.8% | △5.3pt | 25.9% | 20.2% | △5.8pt |

| Marketing Solutions | 28.3% | 24.9% | △3.4pt | 28.7% | 23.9% | △4.8pt |

| HR Solutions | 27.0% | 18.3% | △8.7pt | 28.0% | 23.0% | △5.1pt |

| Staffing | 6.7% | 7.5% | +0.9pt | 6.5% | 7.4% | +0.9pt |

| Japan | 8.2% | 9.9% | +1.8pt | 8.4% | 10.8% | +2.5pt |

| Overseas | 5.5% | 5.4% | △0.0pt | 5.0% | 4.0% | △1.0pt |

*1 The US dollar based revenue reporting represents the financial results of operating companies in this segment on a US dollar basis, which differ from the consolidated financial results of the Company.

*2 The total sum of the three segments does not correspond with consolidated numbers due to Eliminations and Adjustments, such as intra-group transactions.

3. Consolidated Financial Guidance for FY2020

The global economic outlook remains uncertain as some countries are experiencing a second wave of COVID-19 and new restrictions which may impact the Company's business are being implemented.

The Company's consolidated financial guidance for FY2020 is based on the assumption that the spread of COVID-19 will not worsen to the extent it causes severe and prolonged lockdowns of major cities, and the business environment will not deteriorate significantly during the remainder of the fiscal year.

The Company expects the global HR Matching market's recovery and stabilization will be gradual, despite the recent strength in recruiting demand in some industries and increased consumer spending. Some countries and regions have already started to reimplement lockdowns and the Company's business environment continues to evolve rapidly. Therefore the Company's outlook remains cautious.

Consolidated revenue for the six months ending March 31, 2021 is expected to be in the range of 1.10 trillion yen to 1.20 trillion yen, and is expected to be in the range of 2.14 trillion yen to 2.24 trillion yen for FY2020.

Consolidated adjusted EBITDA for the six months ending March 31, 2021 is expected to be in the range of 86.6 billion yen to 121.6 billion yen, and is expected to be in the range of 210.0 billion yen to 245.0 billion yen for FY2020.

Adjusted EPS for FY2020 is expected to be in the range of 62.83 yen to 77.83 yen, assuming the amount of depreciation and amortization and other adjustment items for the six months ending March 31, 2021 to be similar to the six months ended September 30, 2020. Adjusted EBITDA and adjusted EPS are the Company's target management key performance indicators.

Assumptions of FX rates for the consolidated financial guidance for FY2020 are as follows: 107 yen per USD, 121 yen per EUR, 74 yen per AUD.

4. Segment Financial Guidance for FY2020

HR Technology

HR Technology's revenue, on a US dollar basis, for the six months ending March 31, 2021 is expected to be in the range of a decrease of 5% to an increase of 9% from the same period of the previous year.

Adjusted EBITDA margin for the six months ending March 31, 2021 is expected to be in the mid-teens.

In order to improve its revenue trend globally in the short-term and to accelerate revenue growth in the mid-term, HR Technology will invest in sales and marketing activities to acquire new users and clients, and in product enhancements to increase user and client engagement.

Media & Solutions

Revenue for Marketing Solutions, excluding the Rent Assistance Program, for the six months ending March 31, 2021 is expected to be in the range of a decrease of 9% to an increase of 6% yoy. Including the Rent Assistance Program, revenue for Marketing Solutions for the six months ending March 31, 2021 is expected to increase approximately 15% to 30% yoy.

Challenging business environment is expected to continue for Bridal and Dining, while continued stable performance is expected for Housing & Real Estate and Beauty.

Revenue recovery of Travel compared to the six months ended September 30, 2020, supported by the Go To Travel campaign by the Japanese government, is expected.

Revenue for HR Solutions for the six months ending March 31, 2021 is expected to decrease approximately 25% yoy, mainly due to the expectation for continued weak demand for placement services, while the part-time job board services see signs of recovery.

Adjusted EBITDA margin for the six months ending March 31, 2021 for Media & Solutions is expected to be approximately 12%. Media & Solutions expects to continue reducing operating expenses such as advertising, while resuming strategic investments in businesses which have started to show recovery in their revenue trends.

Revenue from the Rent Assistance Program, which is recorded in Others under Marketing Solutions in Media & Solutions for FY2020 is expected to be 93.2 billion yen including tax. However, the total revenue recorded in FY2020 might be lower depending on the number of applicants and recipients of the program.

Staffing

Revenue for Japan operations for the six months ending March 31, 2021 is expected to decrease approximately 10% to 5% yoy mainly due to weak demand for new orders.

Revenue for Overseas operations for the six months ending March 31, 2021 is expected to decrease approximately 12% to 8%.

Adjusted EBITDA margin for the six months ending March 31, 2021 is expected to be approximately 5% primarily due to a decline in adjusted EBITDA margin in Japan operations caused by the decline in revenue and an increase in advertising expense, partially offset by continued cost control measures.

5.FAQ's

Consolidated Financial Guidance and Dividend Forecasts for FY2020

Q1:

Has the impact from COVID-19 changed the Company's mid- to long-term strategy?

A1:

Even during a challenging business environment, the Company continues to make necessary investments, and will reallocate its workforce, in line with the mid- to long-term strategy. There is no change in the mid- to long-term strategy: aim to become the global leader of the HR Matching market, and improve the productivity of clients' businesses through SaaS solutions with a focus on Air BusinessTools.

The relatively flexible cost structure across the three business segments and strong consolidated balance sheet, are factors that enable the Company to execute its mid- to long-term strategy, even during this uncertain period.

Q2:

The Company expects revenue for FY2020 to decrease 6.5% to 10.4% year on year. When will revenue recover to a level similar to the FY2019, pre-COVID-19 level?

A2:

In Q2, while some businesses started to show improving revenue trends quarter on quarter, others have been slow or unable to recover. It is extremely difficult to forecast the Company's revenue growth in FY2021 and onward at this point in time due to ongoing changes in the spread of COVID-19 and governments' responses, and the changing effects of these actions on our enterprise clients and individual users. The Company remains focused on executing its mid- to long-term strategy by proactively adapting to and leading the changes in society driven by COVID-19, while preparing for further growth when the economy recovers.

Q3:

What are the assumptions for the consolidated financial guidance for FY2020?

A3:

The global economic outlook remains uncertain as some countries are experiencing a second wave of COVID-19 and new restrictions which may impact the Company's business are being implemented. The Company's consolidated financial guidance for FY2020 is based on the assumption that the spread of COVID-19 will not worsen to the extent it causes severe and prolonged lockdowns of major cities, and the business environment will not deteriorate significantly during the remainder of the fiscal year. Therefore, the Company is providing financial guidance in a reasonable range for each metric.

The Company expects the global HR Matching market's recovery and stabilization will be gradual, despite the recent strength in recruiting demand in some industries and increased consumer spending. Some countries and regions have already started to reimplement lockdowns and the Company's business environment continues to evolve rapidly. Therefore the Company's outlook remains cautious.

Since FY2019, the Company has disclosed a guidance range for adjusted EBITDA and a target growth rate for adjusted EPS, both of which are management KPIs. However, because of Tokyo Stock Exchange disclosure requirements regarding the crossing of defined thresholds between FY2020 consolidated financial guidance and FY2019 consolidated financial results, the Company is disclosing additional guidance information for FY2020. The Company assumed foreign exchange rates for FY2020 are as follows: JPY107 per US dollar, JPY121 per Euro, and JPY74 per Australian dollar.

| (In billions of yen, unless otherwise stated) | Six months ended September 30, 2020 | Year on year % change | Guidance for six months ending March 31, 2021 | Year on year % change | Guidance for twelve months ending March 31, 2021 | Year on year % change |

|---|---|---|---|---|---|---|

| Revenue | 1,044.6 | △13.0% | 1,105.0 - 1,200.0 | △7.8% - 0.1% | 2,149.6 - 2,244.6 | △10.4% - △6.5% |

| Adjusted EBITDA | 123.4 | △30.6% | 86.6 - 121.6 | △41.2% - △17.5% |

210.0 - 245.0 | △35.4% - △24.6% |

| Operating income | 74.7 | △47.6% | 37.0 - 72.0 | △41.6% - 13.7% |

111.7 - 146.7 | △45.8% - △28.8% |

| Profit before tax | 78.4 | △50.3% | 37.5 - 72.5 | △45.1% - 6.1% |

115.9 - 150.9 | △48.7% - △33.2% |

| Profit for the period | 63.1 | △45.1% | 31.0 - 56.0 | △53.2% - △15.5% |

94.1 - 119.1 | △48.1% - △34.3% |

| Profit attributable to owners of the parent | 62.5 | △45.2% | 30.5 - 55.7 | △53.6% - △15.2% |

93.0 - 118.2 | △48.3% - △34.2% |

| Adjusted EPS (yen) | 41.83 | △38.4% | 21.00 - 36.00 | △60.4% - △32.2% |

62.83 - 77.83 | △48.1% - △35.7% |

Q4:

What is the financial guidance for the second half of FY2020 for the three segments?

A4:

The guidance for the second half of FY2020 for the three segments is provided below. For Marketing Solutions in Media & Solutions, the figures in the upper row of revenue guidance exclude revenue from the Rent Assistance Program by The Small and Medium Enterprise Agency of the Ministry of Economy in Japan ("Rent Assistance Program"), and the figures in the lower row include it.

| (In billions of yen, unless otherwise stated) | Six months ended March 31, 2020 | Year on year change | Six months ended September 30, 2020 | Year on year change | Guidance for six months ending March 31, 2021 |

||

|---|---|---|---|---|---|---|---|

| HR Technology |

Revenue (million US dollars) |

$1,981 | 26.1% | $1,662 | △13.7% | approx. △5% - +9% yoy on a USD basis |

|

| Adjusted EBITDA margin |

12.7% | △0.8pt | 12.7% | △8.2pt | Mid-teens % | ||

| Media & Solutions |

Revenue | Marketing Solutions | 222.2 | 7.9% | 200.8 | △7.2% | approx. △9% - +6% yoy (approx. +15% - +30% yoy) |

| HR Solutions | 153.7 | △5.9% | 103.6 | △35.3% | approx. △25% yoy | ||

| Adjusted EBITDA margin |

22.5% | +0.7pt | 20.2% | △5.8pt | approx. 12% | ||

| Staffing | Revenue | Japan | 290.2 | 5.8% | 284.6 | 2.6% | approx. △10% - △5% yoy |

| Overseas | 327.8 | △9.2% | 288.0 | △18.3% | approx. △12% - △8% yoy | ||

| Adjusted EBITDA margin |

6.5% | +0.4pt | 7.4% | +0.9pt | approx. 5% | ||

Q5:

Interim dividend is 9.5 yen, and year end dividend forecast is 9.5 yen, both of which are lower than that of previous year. Is there any change in the Company's dividend policy?

A5:

There is no change in the Company's dividend policy. Interim dividend and year end dividend forecast were calculated accordingly following the consolidated financial guidance for FY2020 as well as the Company's aim of maintaining a sufficient level of shareholders' equity in order to be able to respond flexibly to investment opportunities for future growth.

The Company considers the return of capital to its shareholders, including through dividends, to be an important part of its capital allocation strategy, and sets a consolidated dividend payout ratio target of approximately 30% of profit attributable to owners of the parent, excluding non-recurring income/losses.

Q6:

What is the Company doing to support those affected by COVID-19?

A6:

Amidst the spread of COVID-19, the Company has continued to prioritize the health and safety of its employees, their families, and their communities. The Company has also focused on supporting individual users, enterprise clients, and business partners, and operates its businesses while implementing measures to help prevent the spread of COVID-19.

In addition, each SBU has leveraged new and existing tools to continue to support all of their stakeholders facing new and unique challenges during this period.(https://recruit-holdings.com/en/covid19/) As a recent example, in HR Technology, Indeed organized a Virtual Hiring Tour in the US, a large scale online hiring event for free (Q10 for more detail).

Consolidated Results

Q7:

Has the Company continued to control operating expenses, including advertising?

A7:

Selling, general and administrative expenses was 231.4 billion yen, a decrease of 8.6% and 21.8 billion yen year on year in Q2 FY2020. The decrease was driven by lower advertising expenses in all three segments, which were 27.1 billion yen, a reduction of 28.6%, or 10.8 billion yen. However, HR Technology and a few subsegments in Media & Solutions increased their advertising expenses compared to Q1 FY2020 due to improving revenue trends. Promotion expenses were reduced and revenue-based sales commissions decreased year on year while increasing quarter on quarter also due to the improving revenue trends in some businesses. Employee benefit expense was 112.5 billion yen, an increase of 3.7% year on year, mainly driven by HR Technology to support continued product innovation.

Q8:

Why did operating income decrease 32.7% year on year, while revenue decreased 6.2% year on year?

A8:

The decline in operating income is mainly because of the decreased operating income from the HR Technology and Media & Solutions segments due to decreased revenue. Also, the lower profitability of the Rent Assistant Program compared to the rest of Marketing Solutions in Media & Solutions, and a slight increase in depreciation and amortization expense contributed to the decrease in operating income.

Additionally, the Company recorded other operating income of 4.6 billion yen and other operating expenses of 6.6 billion yen. Other operating income included approximately 3.6 billion yen, which was recognized as a result of a business combination of Wongnai, a former associate of the Company which operates a restaurant review platform in Thailand. The business combination led to discontinuing the use of the equity method for Wongnai, resulting in the increase in other operating income. Other operating expenses included 1.0 billion yen of additional non-recurring expenses arising from COVID-19 related measures and a 3.9 billion yen impairment loss on goodwill and intangible assets related to Trust You, a company which operates a review management system for the travel industry mainly in Europe.

HR Technology

Q9:

What is the split of revenue between the US and Non-US for the HR Technology segment and how has revenue trended by region during Q2?

A9:

The Company last disclosed the breakdown of its revenue by region for the full-year FY2019 and US revenue was approximately 70% of the total revenue of the HR Technology segment.

However, we have seen different dynamics around the world largely due to government reopening policies and constraints regarding workforce reductions. HR Technology's rebound from the lows in Q1, and continued revenue recovery in Q2, has been led by the US. While many businesses are still struggling and not operating at full capacity, the revenue rebound in Q2 has been largely driven by SMEs that have been able to re-open after the easing of COVID-19 related shutdowns and other restrictions. Enterprises have been slower to start hiring again, but we have seen demand from several very large companies that are hiring in massive numbers in response to demand for particular goods & services in the current environment.

Outside the US, the pace and scale of recovery has varied by country, with demand for hiring in aggregate relatively slower to recover as conditions remain challenging in many countries due to the varying impacts of COVID-19 and the responses from employers and governments.

HR Technology remains cautious regarding the pace and trajectory of continued improvement due to the global spread of COVID-19 and measures to help prevent the spread and how those conditions may affect enterprise client and job seeker activity.

Q10:

What actions has HR Technology taken to invest in innovative and differentiated product enhancements to dramatically simplify recruiting processes and significantly reduce the cost and time to hire for employers?

A10:

HR Technology has focused its investment, and accelerated its innovation, to leverage its data and insights to automate today's manual recruiting processes, in order to make hiring simple and fast. As an example, during the second quarter HR Technology has been able to fully integrate its internally developed Virtual Interview Platform into the Virtual Hiring Events product that was launched in Q1. This allows job seekers and employers to remove technical hurdles and speed up the interviewing timeline, all within Indeed, by automating the search, apply, and interview scheduling processes.

In addition, with unemployment at record high levels in the US, HR Technology broadly introduced Virtual Hiring Events and the Virtual Interview Platform through a national Virtual Hiring Tour, which consisted of a series of events over six weeks across the US in order to help job seekers get back to work quickly and reduce the burden of recruitment for employers, resulting in over 100,000 interviews between job seekers and employers that are ready to hire.

Q11:

What are the latest developments with the Glassdoor and Indeed partnership?

A11:

The mid- to long-term strategy for the HR Matching business is to drastically simplify recruiting and hiring through technology-driven and innovative solutions. As a part of the strategy, Indeed and Glassdoor announced on July 21, 2020 that they are partnering to bring enterprise clients the power of their combined strengths in employer branding and hiring solutions. Employers will be able to reach job seekers on both Indeed and Glassdoor through Indeed job advertising products, and reach a larger and more diverse audience. Also, employers will be able to access reviews and ratings from both Indeed and Glassdoor within the Glassdoor Employer Center. HR Technology will continue to explore further opportunities to accelerate innovation in order to make employer and job seeker activity more efficient.

Please refer to the following release for more details.

Q12:

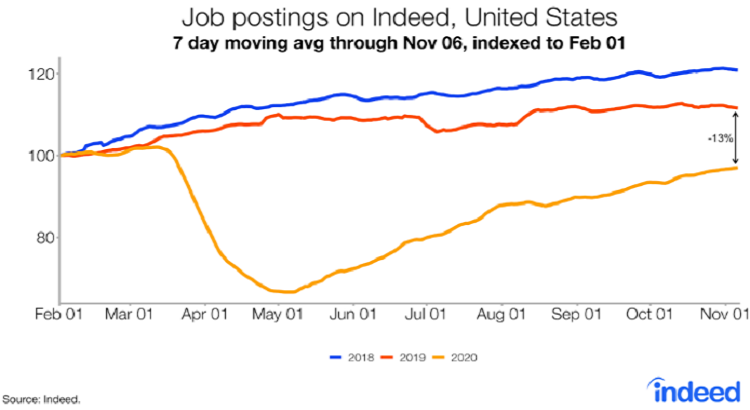

How has COVID-19 continued to impact the number of job postings on Indeed.com? What does the Hiring Lab job posting data tell me about the HR Technology revenue performance?

A12:

The trend in job postings in the US was roughly in line with last year's trend until the second week of March when the spread of COVID-19 impacted demand for hiring. Postings were 2.9% below the 2019 7-day moving average job posting volume trend on March 15 then plunged over the next six weeks with a low point when the growth rate from February 1 to May 1 of the 7-day moving average number of jobs decreased 39.3% in 2020 compared to the growth in jobs during the same period in 2019. There was improvement in May, June, and July as many businesses resumed operations, which then continued but at a slower pace through August, September and October.

The trend in job postings - a real-time measure of labor market activity - is 13.0% lower than the growth trend in job postings in 2019, as of November 6.

The job postings data analyzed by the Indeed Hiring Lab includes paid and unpaid job posts and is not directly correlated to Indeed sponsored job advertising revenue. Therefore, the growth trend of job postings is not directly correlated to the growth trend of HR Technology revenue.

Q13:

What is the outlook for the remainder of FY2020 for HR Technology?

A13:

HR Technology's revenue, on a US dollar basis, for the six months ending March 31, 2021 is expected to be in the range of a decrease of 5% to an increase of 9% from the same period of the previous year. Adjusted EBITDA margin for the six months ending March 31, 2021 for HR Technology is expected to be in the mid-teens. In order to improve its revenue trend globally in the short-term and to accelerate revenue growth in the mid-term, HR Technology will invest in sales and marketing activities to acquire new users and clients, and in product enhancements to increase user and client engagement.

Q14:

Will the new equity-based incentive plan for HR Technology have a significant impact on HR Technology's adjusted EBITDA margin compared to the previous cash-based long term incentive plan?

A14:

Based on the accounting treatment of equity-based incentives, which accelerates the timing of the expense, the Company expects a few percentage point impact in isolation on HR Technology's adjusted EBITDA margins in the short-term, while the expense related to the current cash-based long term incentive plan, which will no longer be awarded, continues to be accrued uniformly through its vesting period. The financial impact from this new equity-based incentive plan is incorporated in the FY2020 adjusted EBITDA margin guidance.

Overall, the Company does not expect this plan to have a significant impact on the long term margins of HR Technology. HR Technology is changing from a cash based incentive plan to an equity based incentive plan which is a more commonly used structure for publicly traded companies globally, and the Company believes it will be a strong tool to both recruit and retain key talent.

HR Technology prioritizes investments that drive long term revenue growth and that includes attracting and retaining highly skilled talent, enabling continued innovation.

Media & Solutions

Q15:

Adjusted EBITDA margin in HR Solutions significantly declined compared to Q1 FY2020. What was the reason for the decline?

A15:

Adjusted EBITDA margin of the placement business in HR Solutions sharply deteriorated in Q2 FY2020 compared to the previous quarter. The placement business operates on a pay-per-hire model in which revenue is recognized when a candidate is hired by an enterprise client. As a result, revenue from the placement business in Q2 FY2020 declined due to reduced hiring demand in the midst of the pandemic during Q1 FY2020. This resulted in a decline in adjusted EBITDA margin of HR Solutions.

Q16:

What is the Company's outlook for 2H FY2020 regarding the performance of Marketing Solutions and HR Solutions?

A16:

Revenue for Marketing Solutions, excluding the Rent Assistance Program, for the six months ending March 31, 2021, is expected to be in the range of a decrease of 9% to an increase of 6% year on year. Including the Rent Assistance Program, revenue for the same period is expected to increase approximately 15% to 30% year on year.

Housing & Real Estate and Beauty are expected to continue stable performance during 2H FY2020. In Travel, the number of bookings on Jalan, the Company's online travel reservation platform, has been rapidly increasing due to the Japanese government Go To Travel campaign which began in late July. On the assumption that the number of bookings continues to increase, revenue is expected to recover during 2H FY2020. In Dining, the number of bookings on Hot Pepper Gourmet, its online restaurant reservation platform, had also been increasing, due to the Go To Eat campaign which began in October. However, as the campaign ended on November 15, the increased number of bookings through the campaign will have a limited positive impact on revenue in Dining for 2H FY2020 due to our advertising-based revenue model. The challenging business environment is expected to continue for Bridal due to reduced demand for wedding ceremonies.

Revenue for HR Solutions for the six months ending March 31, 2021 is expected to decrease approximately 25% year on year. This is mainly due to the expectation for continued weak demand for placement services, while the part-time job board services see recent signs of recovery.

Adjusted EBITDA margin for the six months ending March 31, 2021 for Media & Solutions is expected to be approximately 12%. Media & Solutions expects to continue reducing operating expenses such as advertising, while resuming strategic investments in businesses which have started to show recovery in their revenue trends.

Q17:

Revenue from the Rent Assistance Program was 29.5 billion yen (excluding tax) in Q2 FY2020. How much of an impact will the Rent Assistance Program have on revenue and adjusted EBITDA of Media & Solutions for FY2020? How does it impact the Company's financial position?

A17:

The Ministry of Economy, Trade and Industry (METI) of Japan disclosed that the maximum amount of the consignment fee for the Rent Assistance Program is 93.2 billion yen (including tax) for FY2020. Adjusted EBITDA margin for this program is expected to be lower than that of businesses in Media & Solutions.

While revenue from the Rent Assistance Program includes the consignment fee of all six companies participating in the consortium established to implement the program, only the consignment fee of the Company is included in adjusted EBITDA of Media & Solutions.

In the course of administering this program, the Company receives and temporarily retains rent subsidies which are then paid to SMEs and individual business owners. As a result, 30.7 billion yen of deposits received from the METI are recorded as other current liabilities as of September 30, 2020.

Staffing

Q18:

Why did adjusted EBITDA in Japan operations increase 20.7% year on year while revenue decreased 0.7% year on year?

A18:

Although revenue decreased year on year, adjusted EBITDA increased primarily through the execution of cost controls, including reducing advertising expenses according to the demand and supply balance in the labor market, and continued reduction of travel expenses in response to the spread of COVID-19.

Q19:

For overseas operations, year on year revenue growth in Q2 improved from Q1 and adjusted EBITDA margin also improved to 5.4% in Q2 from 2.2% in Q1. Is this improvement sustainable?

A19:

There have been signs of recovery as monthly revenue year on year continuously improved during Q2. Adjusted EBITDA margin also improved, by strengthening ongoing cost control initiatives. However, we remain cautious about business trends as the business environment surrounding enterprise clients remains challenging.

Q20:

What is the financial guidance for the second half of FY2020 for the Company's staffing business?

A20:

Revenue for Japan operations for the six months ending March 31, 2021 is expected to decrease approximately 10% to 5% year on year mainly due to weak demand for new orders, and revenue for Overseas operations for the same period is expected to decrease approximately 12% to 8%. Adjusted EBITDA margin for the six months ending March 31, 2021 for Staffing is expected to be approximately 5% primarily due to a decline in adjusted EBITDA margin in Japan operations caused by the decline in revenue and an increase in advertising expense, partially offset by continued cost control measures.

6. Audio

7. Results Materials

Latest Investor's Kit(1.02 MB)(ZIP)

Financial Results Summary (270 KB)

Supplemental Financial Data(127 KB)(Excel)

Conference Call Transcript For Q2 FY2020 (166 KB)

Forward-Looking Statements

This document contains forward-looking statements, which reflect the Company's assumptions and outlook for the future and estimates based on information available to the Company and the Company's plans and expectations as of the date of this document or other date indicated. There can be no assurance that the relevant forecasts and other forward-looking statements will be achieved. Please note that significant differences between the forecasts and other forward-looking statements and actual results may arise due to various factors, including changes in economic conditions, changes in individual users' preferences and enterprise clients' needs, competition, changes in the legal and regulatory environment, fluctuations in foreign exchange rates, and other factors. Accordingly, readers are cautioned against placing undue reliance on any such forward-looking statements. The Company has no obligation to update or revise any information contained in this document based on any subsequent developments except as required by applicable law or stock exchange rules and regulations.

Third-Party Information

This document includes information derived from or based on third-party sources, including information about the markets in which the Company operates. These statements are based on statistics and other information from third-party sources as cited herein, and the Company has not independently verified and cannot assure the accuracy or completeness of any information derived from or based on third-party sources.