Newsroom

- IR

Recruit Holdings Announces the Revision of the Equity Compensation Plan and the Stock Option Plan for Directors of the Board

May 17, 2021

Recruit Holdings Co., Ltd. (TSE 6098) (The "Company") announced that its Board of Directors, at the Board meeting held on May 17th, 2021, resolved to propose the revision of the equity compensation plan for Directors of the Board, etc. which has been introduced since Fiscal Year 2016 and has been partially revised in Fiscal Year 2018, and the revision of the stock option plan for Directors of the Board (excluding Outside Directors) which has been introduced since Fiscal Year 2019 to the 61st Annual Meeting of Shareholders to be held on June 17th, 2021 (The "Shareholders' Meeting"), as follows.

1. Revision of the Equity Compensation Plan for Directors of the Board, etc.

Overview of Revision of Plan

At the 58th Annual Meeting of Shareholders held on June 19, 2018 (The"2018 Shareholders Meeting"), the Company received approval concerning the equity compensation plan in which shares of the Company are granted to Directors of the Board, Corporate Executive Officers, and Corporate Professional Officers., . In conjunction with legislative amendments to the Companies Act of Japan which went into effect on March 1st, 2021, as well as changes made to the policy for determining the compensation, etc. for Directors of the Board which have been made since the original approval, the Company plans to amend the matters approved at the 2018 Shareholders' Meeting, and resubmit the amended equity compensation plan for Directors of the Board (excluding outside Directors; this exclusion applies hereafter in this Paragraph 1.) (The "Plan") for approval from the shareholders.

The main changes to the Plan approved at the 2018 Shareholders' Meeting are as follows.

Revision of sections " Maximum amount of money contributed by the Company" and Maximum number of shares of the Company to be acquired by the Trust as compensation for Directors for one fiscal year." in the "Overview of the Plan".

Revision of the section "Eligible Recipients" in the "Overview of the Plan" to apply to Directors.

Partial revision of the content of the section " Timing of the Vesting of the Shares, etc." in the "Overview of the Plan" to add a specified timing.

Addition of the section (6) "Forfeiture of points" to the "Details of the Plan."

The Plan will operate, as before, under the structure of a trust based Board Incentive Plan (The "BIP Trust"). Under the BIP Trust, shares of the Company are acquired through a trust (The "Trust") established with funds contributed by the Company, and the shares of the Company and the money equivalent to the value of those shares (the "Shares, etc."), are delivered or paid ("Vesting") to Directors of the Board through the Trust.

The Company believes it is appropriate to continue this Plan as it is in line with the Company's intention to create a clear link between compensation for Directors of the Board and the value of shares of the Company, and to increase awareness of the long term contributions they make to the Company's enterprise value. This proposal to revise the Plan is made based on the result of deliberations by the Compensation Committee. This committee is chaired by an outside Director, and a majority of its members are outside Directors and outside Audit & Supervisory Board members.

Overview of the Plan

| Maximum amount of money contributed by the Company | - 2 billion yen per fiscal year |

|---|---|

| Maximum number of shares of the Company to be acquired by the Trust as compensation for Directors for one fiscal year | - 700,000 shares per fiscal year 1 |

| Method used by the Trust to acquire shares of the Company | - Acquire shares from the open market |

| Eligible Recipients | - Directors of the Company |

| Details of performance target conditions | In the case of performance-based compensation:- The level of contribution to the achievement of corporate performance goals designated by the Company aimed at increasing enterprise valueIn the case of non-performance-based compensation:- None |

| Timing of the Vesting of the Shares, etc. | - At the time of their retirement or a certain time during their tenure in office 2, 3 |

1 Under the Plan, the Trust will acquire shares of the Company from the open market so there will be no dilution.

2 Only talent who are hired based on market standard employment practices or laws that significantly differ from those of Japan are eligible to Vesting during their tenure.

3 The Company may grant shares under this Plan each fiscal year. When the Vesting of shares occurs in a single installment, the timing of Vesting of shares during the recipient's tenure of office will not occur until at least two years or more have passed from the start date of the fiscal year in which the recipient is eligible to receive grants under the Plan. When the Vesting of shares occurs in multiple installments, the Vesting of shares during the recipient's tenure of office will not begin until at least one year has passed from the start date of the fiscal year in which the recipient is eligible to grants under the Plan and, in that case, the average length of the period required for the Vesting to be completed shall be two years or more.

For example, the following schemes may be used to meet this requirement:

- Of the shares to be granted, one-third will be vested after one year, one-third after two years, and one-third after three years (in this case the average length of the period is two years); and

- Of the shares to be granted, one-quarter will be vested after one year, one-quarter after two years, one-quarter after three years, and one-quarter after four years (in this case the average length of the period is 2.5 years).

In contrast, the following are examples of schemes that will not be used because they do not meet the above requirement:

- Of the shares to be granted, one-half will be vested after one year, and one-half will be vested after two years (in this case the average length of the period is 1.5 years); and

- A scheme in which all the shares to be granted will vest after only one year has passed.

Background of the equity compensation plan

Recruit Group has been active and purposeful in driving business development in global markets. As a result, the ratio of overseas revenue has increased from approximately 3% in the fiscal year ended in March 2012 to approximately 45% in the fiscal year ended March 2021.

In order to continue to increase the enterprise value of Recruit Group, it is extremely important for management to build a business foundation that can serve as a platform in the global market and develop it into a business with the potential for business expansion on a global scale. This idea has served as an important theme for management. To that end, the Company recognizes that it is essential to welcome elite talent with a wealth of knowledge and management experience in the global market.

With respect to the compensation of overseas corporate management, it has been observed as a common practice for recipients' equity compensation to vest flexibly during their tenure in office. Including these practices in the Company's executive compensation plan is a necessary tool in order to compete with global companies and have the flexibility to secure elite management talent. With this in mind, the Company designed the Plan so that the shares granted to management talent may vest during their tenure at the Company, only if their individual market standards differ significantly from that of Japan.

Details of the Plan

(1) Maximum amount of money contributed by the Company

The Company shall establish a Trust (including an extension of the trust period as described in the third paragraph of this Section (1); the same shall apply hereafter), contributing money to the Trust as compensation to the Directors up to a maximum of 2 billion yen for each fiscal year. The Trust will follow the instructions of the trust administrator and will acquire shares of the Company from the stock market using the funds provided to the Trust; the Company will award points to the Directors (as described in (2) below) and each Trust will deliver the Shares, etc. of the Company equivalent to the points awarded.

The Company may establish multiple Trusts in a single fiscal year. In such cases, the combined total amount of trust money to be contributed to all Trusts will not exceed the maximum amount of 2 billion yen. Furthermore, in the case where the Trust cannot be established in a certain fiscal year due to applicable laws or other reasons, the Trust for the target fiscal year may be established at an appropriate time in or after the following fiscal year. In such cases, the established Trust will be subject to the maximum amount of trust money of the fiscal year in which the Trust was intended to be established and the maximum amount of trust money for the fiscal year in which the Trust was actually established will not apply.

At the expiry of the trust period of each Trust, the Company may operate the Plan by continuing the Trust by means of amendments to the trust agreement or additional contributions to the Trust, instead of establishing a new Trust. In such cases, the Company shall make an additional contribution of up to 2 billion yen in total per fiscal year, shall continue to award points to Directors during the extended trust period, and shall continue to Vest the Shares, etc. of the Company to the Directors during the extended trust period.

If amendments to the trust agreement or additional contributions to the Trust are not carried out at the expiry of the trust period of each Trust, and if the Directors who may meet the beneficiary requirements remain in office, no points shall be awarded to such Directors after the expiry, but the trust period of the Trust may be extended for a period of up to ten years until the completion of the Vesting of the Shares, etc. of the Company to such Directors.

(2) Calculation method and maximum number of Shares, etc. of the Company to be Vested to the Directors

The Company shall award points to each Director according to their individual rank and, if the compensation is performance-based, the level of achievement of performance targets. The number of the shares of the Company to be vested from each Trust to the Directors under the Plan shall be determined as one share per point.

In the event of an increase or decrease in the number of the shares of the Company held in the Trust due to a share split, a gratis allotment of shares, a share consolidation, or other initiatives involving shares, the Company will make an adjustment to the number of the shares of the Company vested to the Directors. for each point in proportion to the ratio of such increase or decrease.

Formula to calculate points

In the case that the calculation is based on the value of equity compensation, the value shall be calculated as the value of equity compensation divided by the average acquisition unit price of the shares of the Company held in the Trust (if the trust period is extended by means of amendments to the trust agreement or additional contributions to the Trust, this shall be the average acquisition unit price of the shares of the Company acquired by the Trust after such extension of the trust period).

In the case that the calculation is based on the number of shares for equity compensation, the number of shares for equity compensation shall be calculated as one share per point.

- In the case of non-performance-based compensation, the amount of equity compensation shall be set at a standard amount based on the individual rank of the Directors.

- In the case of performance-based compensation, the amount of equity compensation shall be calculated by multiplying the standard amount based on the individual rank of the Directors by performance-linked factors according to the degree of achievement of performance target indicators. If the level of achievement of the performance target indicators is low, contribution under the Plan may not be made.

The maximum number of the shares of the Company to be acquired by the Trust as compensation for Directors for one fiscal year is 700,000 shares per fiscal year. This maximum number is set based on the most recent stock prices of the Company, in light of the (1) " Maximum amount of money contributed by the Company described above.

(3) Method and timing of Vesting of shares to the Directors

The Directors that meet the beneficiary requirements shall receive the shares of the Company from the Trust in proportion to the accumulated number of points calculated based on (2) above (The "Accumulated Points") at the time of their predetermined retirement or a certain time during their term of office (however, as specifically described in the section " Timing of the Vesting of the Shares, etc.," when the Vesting of shares occurs in a single installment, the timing for the Vesting of shares during the recipient's tenure of office will not occur until at least two years or more has passed from the start date of the fiscal year in which the recipient is eligible to receive grants under the Plan. When the Vesting of shares occurs in multiple installments, the period of the Vesting of shares during the recipient's tenure of office will not begin until at least one year or more has passed from the start date of the fiscal year in which the recipient is eligible to receive grants under the Plan and, in that case, the average length of the period required for the Vesting to be completed shall be two years or more.)

In such instances, the Directors may be vested in the shares of the Company at a certain ratio to the Accumulated Points (where odd lot shares less than one unit are rounded down to the nearest whole unit), while the remaining shares of the Company corresponding to the points are converted to money within the Trust and the money equivalent to the value of such shares are paid to the Directors.

If a Director does not have a securities account that can administer Japanese shares, all the Accumulated Points are converted to money within the Trust and the money equivalent to the value of the Accumulated Points is paid to the Director.

In the event of the death of a Director during their term of office, the shares of the Company corresponding to the Accumulated Points up to the time of death of the Director shall be converted to money and the money shall be paid to their heirs from the Trust.

(4) Voting rights for the shares of the Company held in the Trust

For the purpose of ensuring neutrality in management, no voting rights shall be exercised for the shares of the Company held in the Trust during the trust period.

(5) Handling of surplus dividends relating to the shares of the Company in the Trust

Dividends of surplus relating to the shares of the Company in the Trust shall be received by the Trust and used for trust fees and trust expenses. If there are any dividends remaining at the end of the trust period, after being used for trust fees and trust expenses, the remainder will be donated to groups that have no vested interest in the Company.

If the Trust is to continue to be used, the remaining dividends will be used as share acquisition funds.

(6) Forfeiture of points

In the event of a serious breach of duties or a serious breach of internal rules regarding a Director, all or part of the points awarded to such Director may be confiscated.

(7) Other details of the Plan

Other details concerning the Plan shall be specified at a meeting of the Board of Directors of the Company when establishing the Trust, amending the trust agreement, or making additional contributions to the Trust.

2. Revision of the Stock Option Plan for Directors of the Board Excluding Outside Directors

The proposal to issue stock acquisition rights as stock options within the limit of 700 million yen per year as compensation for Directors of the Board (excluding outside Directors; this exclusion applies to the entirety of this proposal, and The "Director(s)") separately from the BIP Trust was approved at the 59th Annual Meeting of Shareholders held on June 19, 2019 (The "2019 Shareholders' Meeting"),. The Company plans to propose to the Shareholders' Meeting an increase of the maximum value of the stock options for each fiscal year from 700 million yen to 1.4 billion yen, with the intention of making use of the stock options proactively and flexibly in order to be competitive with global companies and secure elite management talent whose interests will be aligned with shareholders and executives.

Regarding the details of the stock options, considering legislative amendments to the Companies Act of Japan that came into effect on March 1, 2021, as well as changes to the policy for setting compensation for Directors of the Board the Company has made certain additions to the content that was approved at the 2019 Shareholders Meeting , and will again seek the approval of shareholders.

The main changes to the proposal approved at the 2019 Shareholders' Meeting are as provided in the sections titled " Total Number of Stock Acquisition Rights," " Exercise Period of Stock Acquisition Rights," and "Conditions for the acquisition of stock acquisition rights" under "Details of Stock Options ( Stock Acquisition Rights ) for Directors of the Board."

Purpose of Introducing Stock Options (Stock Acquisition Rights) for Directors of the Board

The Company will issue stock acquisition rights as compensation, the benefits of which are realized only if the stock price rises, in order to share the advantages and risks of stock price fluctuations with shareholders and to motivate Directors of the Board to contribute to stock price appreciation and corporate value enhancement. The amount of compensation and detailed terms with respect to the stock acquisition rights as stock options are determined based on the status of the performance of duties and contributions by Directors of the Board. The proposal to revise the stock option plan will be made taking into account the results of deliberations by the Compensation Committee. This committee is chaired by an outside Director, and a majority of its members are outside Directors and outside Audit & Supervisory Board members.

Details of Stock Options (Stock Acquisition Rights) for Directors of the Board

(1) Total Number of Stock Acquisition Rights

The maximum number of stock acquisition rights to be issued within one year after the Company's Annual Meeting of Shareholders for each fiscal year is 18,000.

(2) Class and Number of Underlying Shares of the Stock Acquisition Rights

The class of underlying shares of the stock acquisition rights shall be common stock of the Company, and the number of shares underlying one stock acquisition right (The "Number of Shares") shall be 100 shares.

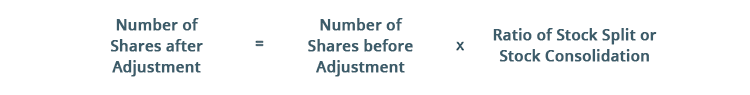

If the Company carries out a stock split (including gratis allotment of common stock of the Company; the same applies hereinafter with respect to a stock split) or stock consolidation after the allotment date of the stock acquisition rights (The "Allotment Date"), the Number of Shares will be adjusted in accordance with the following formula, and any fraction less than one share resulting from the adjustment shall be rounded down to the nearest whole share.

If, after the Allotment Date, the Company carries out a merger or company split, or any unavoidable circumstances that require an adjustment of the Number of Shares otherwise occurs, the Company may adjust the Number of Shares to a reasonable extent.

(3) Amount to be Paid in for Stock Acquisition Rights

No cash payment is required to receive stock acquisition rights.

(4) Amount of Assets to be Contributed upon Exercise of Stock Acquisition Rights

The amount of assets to be contributed upon exercise of one stock acquisition right shall be the amount calculated by multiplying the amount per share of the assets to be contributed upon exercise of the stock acquisition rights (The "Exercise Price") by the Number of Shares.

The Exercise Price shall be the closing price of the common stock of the Company in regular trading on the Tokyo Stock Exchange on the Allotment Date (or, if there are no transactions in relation to the shares of the Company on such date, the closing price on the trading day immediately before the Allotment Date).

If the Company carries out a stock split or stock consolidation after the Allotment Date, the Exercise Price will be adjusted according to the following formula, and any fraction less than one yen resulting from the adjustment shall be rounded up to the nearest whole yen.

If, after the Allotment Date, the Company carries out a merger or company split, or an event that requires an adjustment of the Exercise Price otherwise occurs, the Company may appropriately adjust the Exercise Price to a reasonable extent.

(5) Exercise Period of Stock Acquisition Rights

The Board of Directors of the Company may determine the exercise period of the stock acquisition rights within the period that commences one year from the start date of the fiscal year in which the Allotment Date of the stock acquisition rights occurs and ends within 10 years from the Allotment Date.

For reference

The allotment agreement to be executed with the recipient of an allotment of the stock acquisition rights will provide for a limit on the number of the stock acquisition rights that may be exercised for a certain period of time so that the plan may fully function to motivate said recipient to contribute to the appreciation of the Company's stock price and to enhancing enterprise value.

In principle, stock acquisition rights cannot be exercised in their entirety unless three years or more have passed from the start date of the fiscal year to which the Allotment Date occurs, In exceptional cases, the exercise period may be set so that all stock acquisition rights can be exercised within three years, however, only if the Compensation Committee, which is chaired by an independent outside director and the majority of the members are external members, determines that this exception is necessary to acquire excellent management talent globally.

(6) Conditions of Exercise of Stock Acquisition Rights

- If a holder of the stock acquisition rights (The "Stock Option Holder") loses all of his or her status as a Director of the Board and/or a Corporate Executive Officer of the Company, such Stock Option Holder may exercise the stock acquisition rights only for the period up to the earlier of the day that is three years from the date of the retirement or the last day of the exercise period of the stock acquisition rights.

- Other conditions will be determined by the Company's Board of Directors.

(7) Restrictions on Assignment of Stock Acquisition Rights

Assignment of the stock acquisition rights shall require the approval of the Company's Board of Directors.

(8) Conditions for theAcquisition of Stock Acquisition Rights

If the stock acquisition rights cannot be exercised due to the provisions of the paragraph titled "Conditions of Exercise of Stock Acquisition Rights" above or the stock acquisition rights allotment agreement before the Stock Option Holder exercises those rights, the Company may acquire the stock acquisition rights free of charge on a date separately determined by the Board of Directors of the Company.

(9) Other Terms of Stock Acquisition Rights

Other matters relating to the stock acquisition rights will be determined by the Company's Board of Directors.