Recruit Group in Numbers

Net sales

3.42Trillion yen

Adjusted EBITDA

545.0Billion yen

Group employees

58k

Since founding

64years

Vision, Mission & Values

We seek to provide "Opportunities for Life" much faster, surprisingly simpler and closer than ever before.

Since our foundation, we have connected individuals and businesses offering both a multitude of choices. In this era of search, where information has become available anytime anywhere, we need to focus more on providing the optimal choice.

Learn moreLeadership

Masumi Minegishi

Representative Director and Chairperson

Hisayuki Idekoba

Representative Director,

President and CEO

Ayano Senaha

Director

Rony Kahan

Director

Naoki Izumiya

Independent Director

Hiroki Totoki

Independent Director

Keiko Honda

Independent Director

Katrina Lake

Independent Director

Headquarters

1-9-2 Marunouchi, Chiyoda-ku, Tokyo

Learn moreHistory

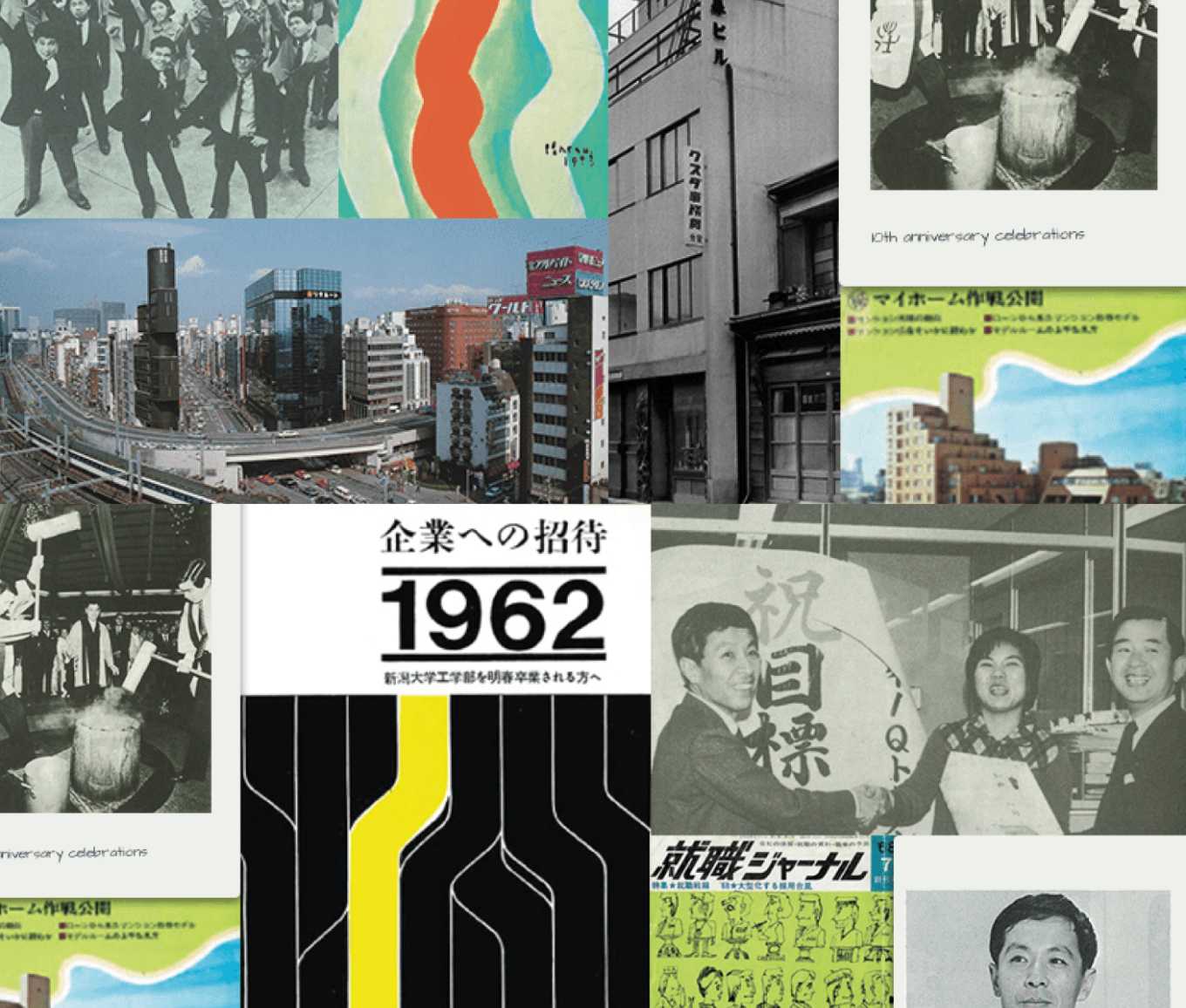

Our Value Creation - Evolving with the Times

Recruit Group was launched in 1960 in a small prefabricated rooftop unit in Tokyo. The Group's first product was a job-hunting magazine for university students called "Invitations to Companies," and its goal was to create an open job market for new graduates by widely disclosing recruitment information.

Learn more

Corporate Blog

Inside Out

View all storiesInside Out is where we tell our stories that cannot be conveyed through numbers alone. Recruit Group believes that the thoughts of each individual—Inside—are connected to our creation of value for society—Outside.

Career

People are our Strength

As one of Recruit Group’s core values, Recruit will always “Bet on Passion” and respect individual differences. We believe encouraging our diverse group of talented and passionate employees to pursue their curiosity to the fullest extent, engage in friendly competition, and collaborate on new ideas will lead to results that exceed our expectations.

Whether it be for Recruit Group domestically, or overseas, we are seeking colleagues with expertise in the areas of Corporate Planning, Finance, HR, IR, Sustainability, and Risk to join our team and help us grow globally.

Learn more